QuiCQ 29/08/2024

The Day After

“It is not the man who has too little, but the man who craves more, that is poor.”

— Seneca

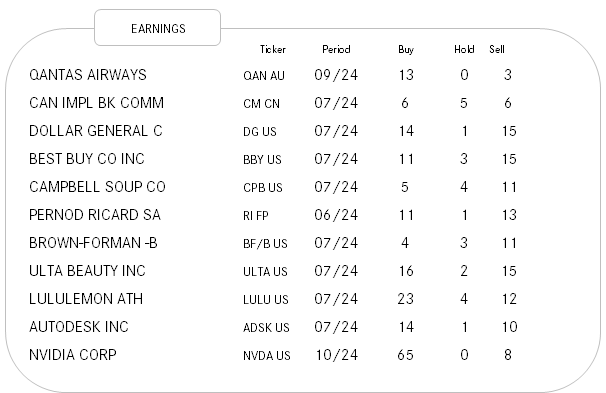

Bloomberg comments: “Stocks in Asia slipped as Nvidia Corp. earnings lacked the wow factor to impress investors…”

This are the headlines that hit the wire after the NVDA earnings release:

I guess that: “with great price-to-sales ratios come great responsibilities” …

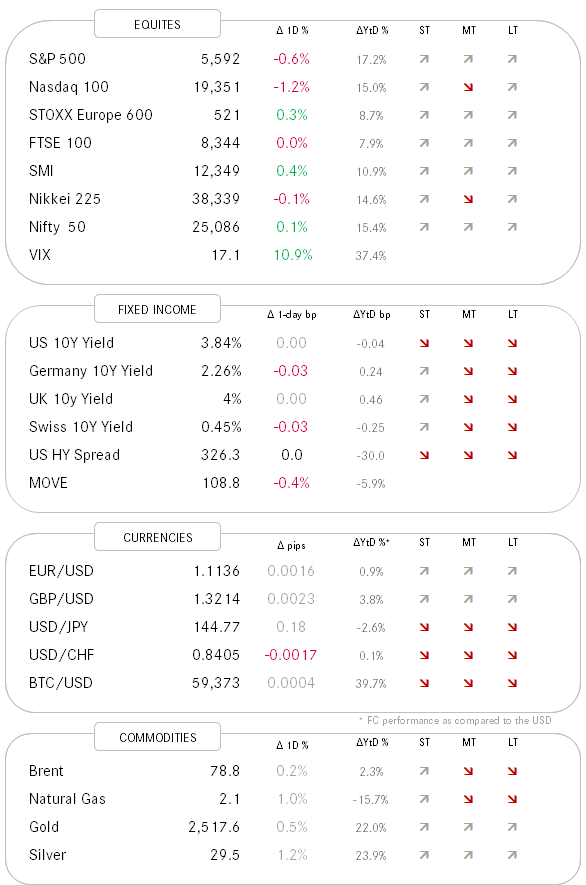

Anyway, with this out of the way now, we finally can look at the other 13,011 stocks in the investable universe. The (pre-NVDA) S&P 500 closed lower yesterday, and only two sectors (health care and financials) printed green on the day. Nevertheless, the up/down ratio at 215:282 was once again not tilted to the extreme negative side and only two stocks hit a new 52-week low versus 54 a new 52-week high.

As forementioned, Asian stocks opened weaker post-NVDA, but as I type have reclaimed most of their early losses and are close to break even with selected markets such as India already in positive territory.

Still little movement on the rates side, so we skip that and have a quick look at currency markets, where the US Dollar is somewhat softer against most currencies after a strong rally yesterday. The strength of the Swiss Franc stands out however, especially versus the Greenback, which is closing in on the 2015 lows and, if closing at the current level (0.8405) would the lowest close for the year:

German CPI and US GDP of some focus today, but tomorrows US PCE will probably get more attention.

To put it British, SMCI is having a jolly bad week this week. First a Hindenburg acquisition and then the company has to delay the filing of their annual report…

Do NOT catch THAT falling knife!