“I don't fast to lose weight, I fast to save money.”

— Harvey, 9½ Weeks (1986)

Prefer to read today’s QuiCQ in PDF? Download here:

Only a short note today, as you are probably hopefully still reading and digesting all the gems in yesterday’s Quotedian (“From Russia with Gas”), plus Monday’s session was probably the most exciting one in what should be a very emotional … volatile … difficult … thrilling 9½ days period? Why 9½ days? Well, because it spans the period from yesterday until just about Thursday morning next week. In that short period we got/get

Israeli retaliation on Iranian targets (27/10)

a general election in Japan (28/10)

US and Eurozone GDP (30/10)

CPIs in Europe (Germany, Spain, France, Italy, etc.)

Halloween (31/10)

US Non-Farm Payrolls (1/11)

US ISM readings (5/11)

US President, Senate and House of Representatives Election (5/11)

and to round it all off a FOMC meeting (7/11)

Bonus Track: earnings of five of the Magnificent Seven

And I am sure I have forgotten a couple of other key events!

But back to yesterday, where the big macro move of the day was a 6%-plus slump in the price of crude oil, after Israel did not attack energy-related targets in Iran and Iran itself reacted pretty tamed to the attacks.

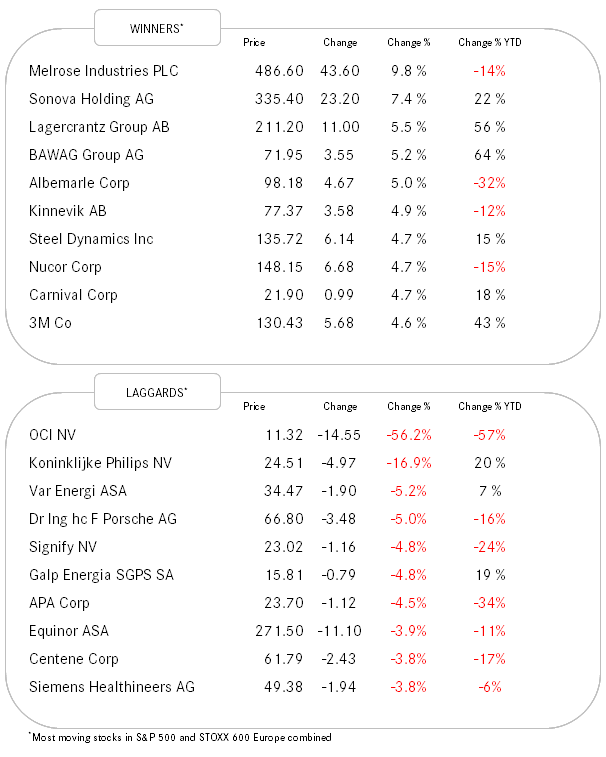

Equities closed mostly higher around the globe, with the S&P 500 for example eking out a 15 points (0.25%) advance. A bit more than twice as much stocks rose than fell on that index, and only two sectors (Energy and Tech) closed lower on the day. In Europe, Dutch conglomerate Philips stood out with a 16% share price drop after it lowered its sales outlook, citing weak demand in China.

This morning, Japan’s Nikkei is up (as most of the rest of Asia) for a second consecutive day, despite the Nation’s leading party losing majority in Sunday’s general election for a first time since 2009.

Staying in the area, the Yen recovered somewhat from its previous day slump versus the US Dollar.

In bond markets, the US Treasury yield pushed further towards 4.30%, though it is off the highs this early Tuesday. Part of this may be the Trump Trade we spoke about last week, but the “initiator” for the bond sell-off was really the FOMC 50 bp cut in mid-September. It may be that investors are not paying enough attention to this, especially equity investors …

Bitcoin has finally pushed above 70,000 and is presenting us now with an extremely bullish chart, especially if the previous high at around 73,200 can be overcome. The technical price target count in such a case would go easily above 100k!

HOWEVER, we must take into account that the current advance could be part of the TT (Trump Trade). For sure, all betting data now points to a clear Trump win, though the admittedly even less reliable poll offices, are giving conflicting messages.

In short, it is now to Trump to lose this election and Bitcoin’s fait me be closely related, at least short-term, to the outcome next week.