QuiCQ 30/01/2025

FOMzzzzzzz....

“A good rule to remember for life is that when it comes to plastic surgery and sushi, never be attracted by a bargain.”

— Graham Norton

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

The macro event of yesterday’s session supposed to be the FOMC meeting, but it seems the decision not to move had been already to well telegraphed by the Fed to have any impact. Either that, or everybody is still distracted with DeepSeek and earnings from some mega-caps due after yesterday’s closing bell.

Whilst the press conference lagged any element of dramatism, particular it failed to ignite in any meaningful manner Powell’s arch-enemy Trump, there was a moment where the Fed Chair explained that omitting the text “making progress on inflation goal” was not meant did the Fed did not make progress. This was interpreted as dovish not hawkish and was a turning for stocks (red) and bonds (grey), with the former climbing back from max intraday losses and the latter seeing yields falling back to their starting point:

As mentioned, the S&P 500 closed off its intraday lows, but still down 0.5%. Some pressure from Nvidia (-4%) again after reports showed that the US administration is discussing further sales restrictions on the company’s sales to China.

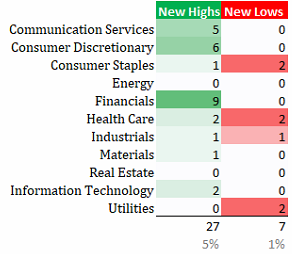

The index itself saw more losers (296) than winners on the day (207), but the number of stocks hitting a new 52-week high versus those reaching a new 52-week low speaks a substantially more bullish language:

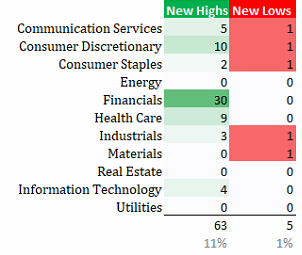

By the way, the same is true for European stocks (SXXP):

A lot of focus was on three of the Mag 7 reporting yesterday, though even that was a bit anti-climax … biggest mover was MSFT (-4%) on beating estimates but disappointing cloud sales. Tesla (+4%) and Meta (+2%) were the other two gunslingers reporting.

As mentioned, little else to report back from the macro world, where investors are probably still licking their wounds from the first the past two weeks.

Maybe only worth mentioning the Japanese Yen, which was bucking the trend versus an otherwise stronger US Dollar against other majors. It really feels, like this chart wants to move lower (i.e. JPY higher):

Today, the economic agenda is sustainably busier than previous days, with the highlight probably being the ECB meeting at European lunch time and a 25 basis cut expected:

BTW, for completeness purposes, the Fed did not move yesterday as described above, but Sweden’s Riksbank and the Bank of Canada both delivered hawkish cuts.

Yesterday, the Bank of Canada and the Riksbank cut their key policy rate and the ECB is destined to do so today. Hence, the only “dissident” is the FOMC, which decided to hold. Maybe one of the 3,846 PhD’s at the Fed is simply looking at the prices of food, via the DB Agricultural ETFs. This ETF just reached a new cycle high and its highest level since 2014:

Stay tuned (and pay up at the grocery store)!