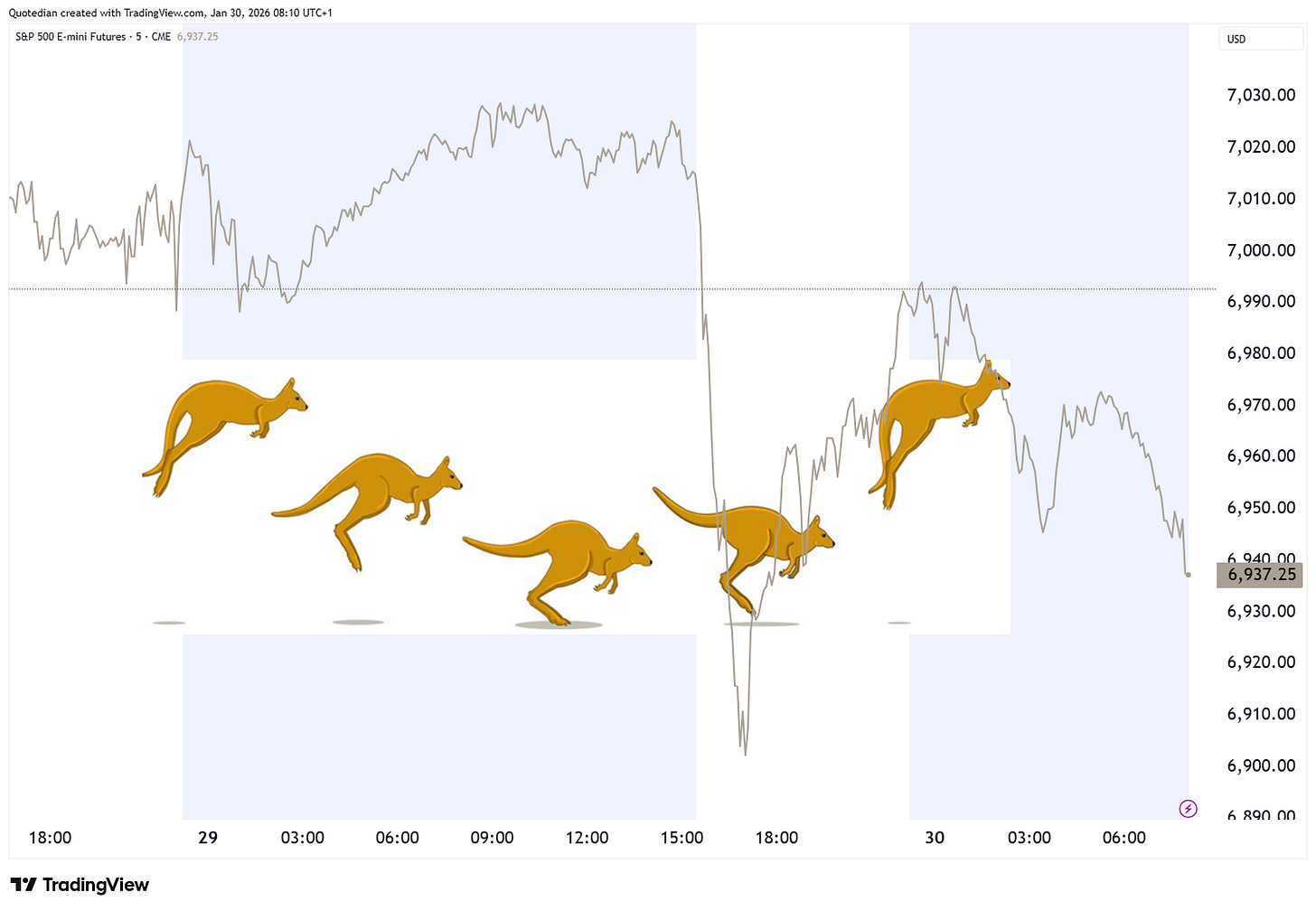

QuiCQ 30/01/2026

Yo-Yo Days

“The market is a pendulum that forever swings between unsustainable optimism and unjustified pessimism.”

— Benjamin Graham

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

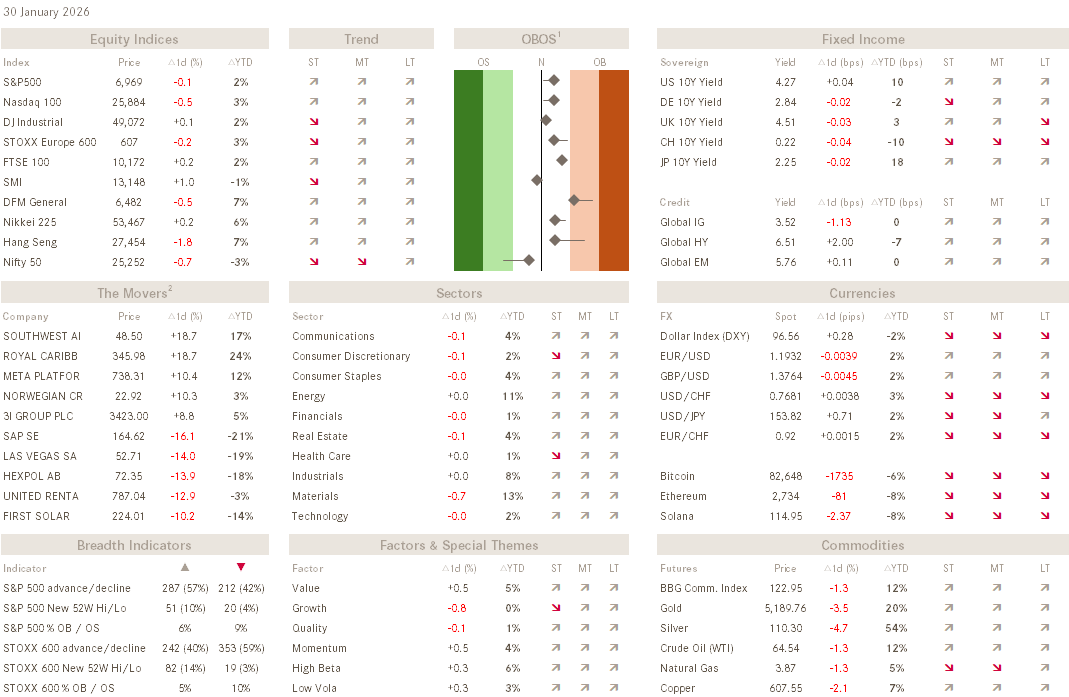

Some of the recently more runaway asset classes, such as for example the precious metals complex, have gone over the past 48 hours or so in full yo-yo (aka Kangaroo) mode. Point-in-case: Gold!

In case you did not notice, that’s a top-to-bottom eight percent range, with some wild swings in between!

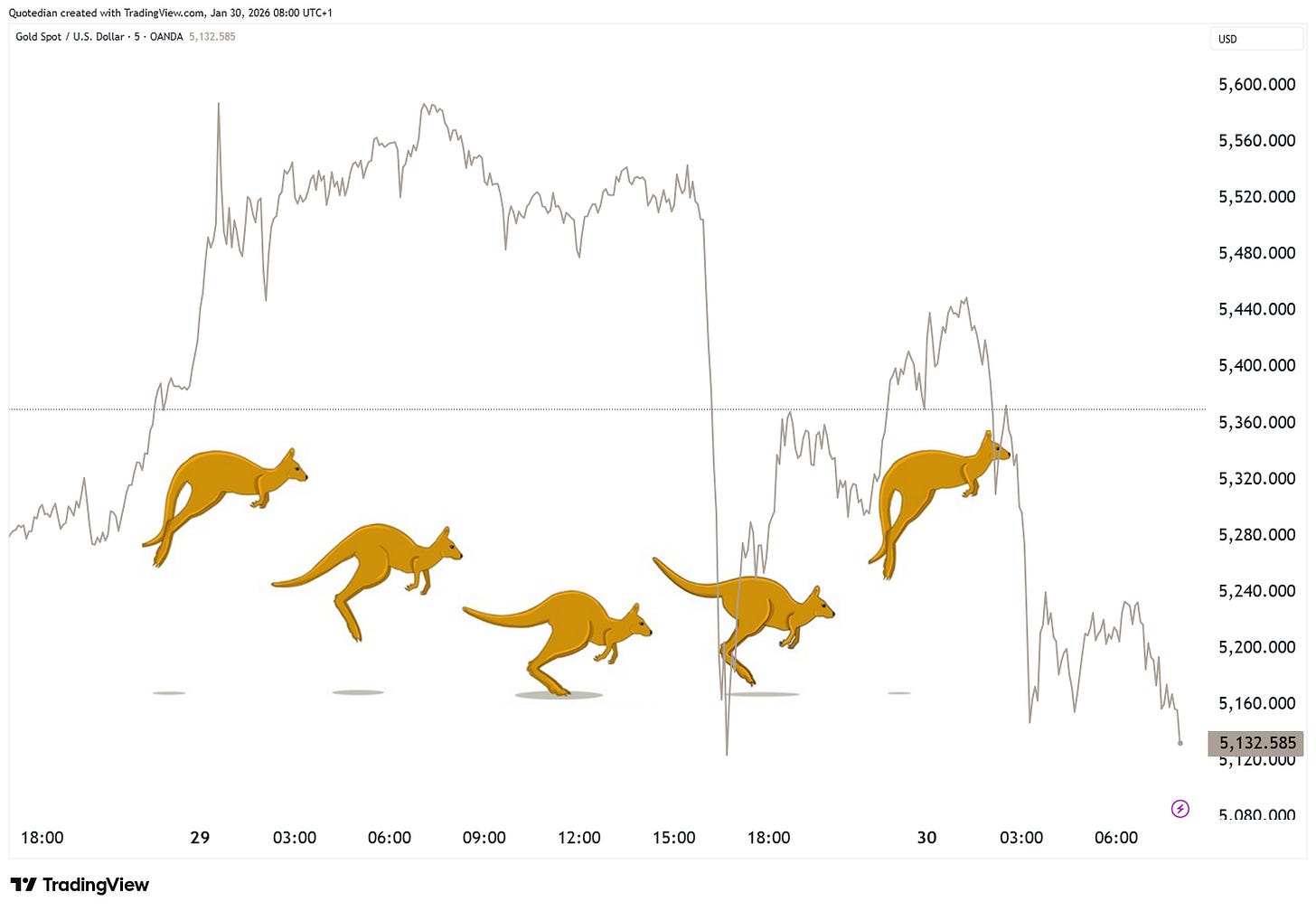

Or Silver’s nearly 12% range:

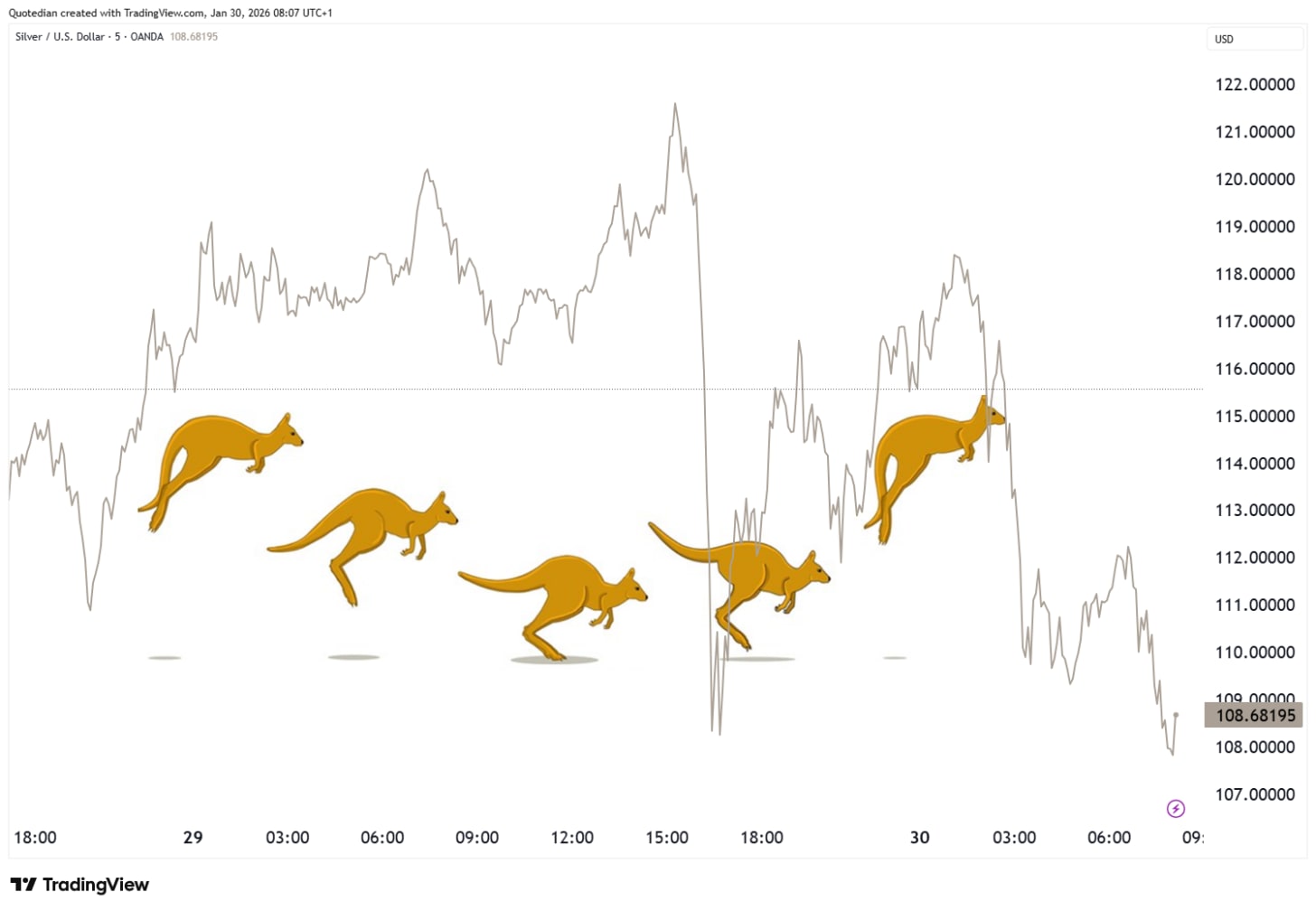

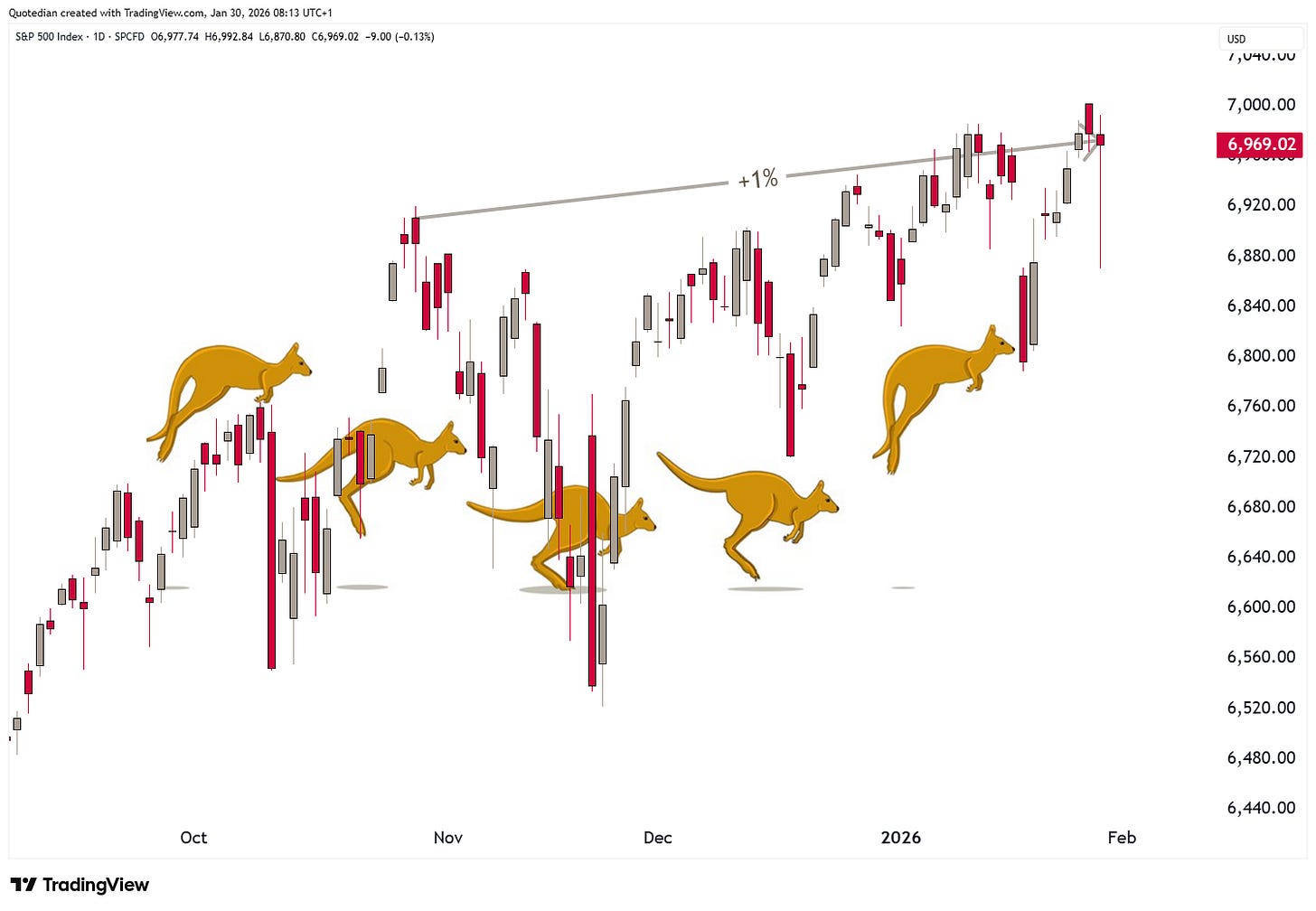

Equity markets, albeit on a much smaller scale, also had their yo-yo or kangaroo momentum over the past two sessions. Here’s the S&P 500 as representative of this asset class:

Albeit, all truth being told, it has been a bit a kangaroo market for the S&P 500 since October of last year, with the index barely one percent higher than four months ago:

Culprits for the sub-par performance of the S&P 500 must be surely the Mag Seven, which, with the exception of Google, have shown a mediocre performance. Here’s the S&P 500 heatmap for the past three months:

Stocks have held up, but is Bitcoin, a classic risk-on/risk-off tool foretelling the (equity) future?

As we head into the weekend, I repeat from last week, the pattern we have seen so far this year:

Weekend 1/2026: Maduro extraction

Weekend 2/2026: Powell subpoena

Weekend 3/2026: Greenland threat

Weekend 4/2026: Pause (probably there was a golf tournament in Mar-o-Lago

Weekend 5/2026: ???

With regards, and no pun or hint or whatever intended, here’s the price of oil (Brent) over the past month:

Have a relaxing, hopefully news-free weekend!

André

Can’t remember when, but in one Quotedian we mentioned that precious metals are usually the first movers in a commodity boom, followed by industrials and eventually oil reacting last.

So, here we go: