QuiCQ 30/08/2024

Uninversion imminent

Prefer to read today’s QuiCQ in PDF? No prob, download it here!

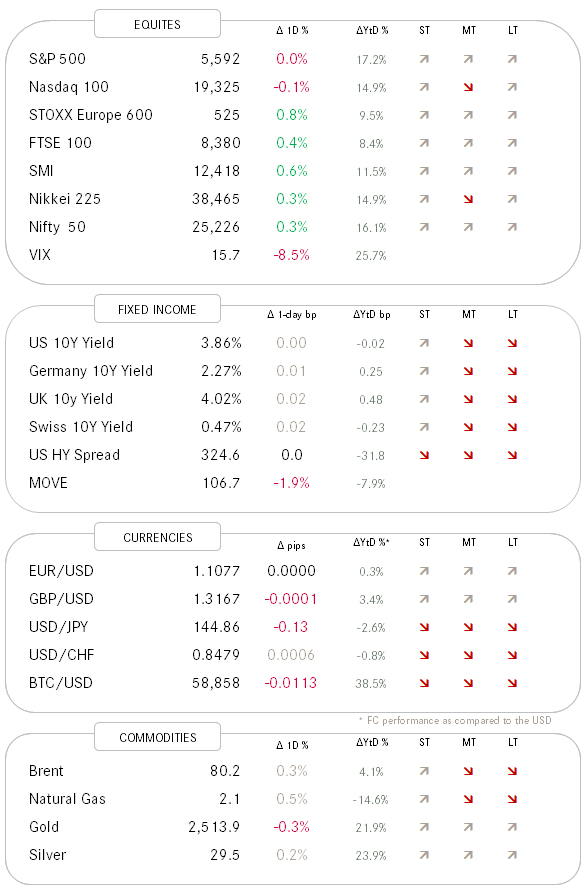

In yesterday’s session equity markets bravely fought NVDA’s “disappointing” results, however, a very decent one percent intraday rally had completely deflated by end of the session for the S&P 500 to close as flat a pancake. Though the session left a positive taste in the investors’ collective mouth anyway, with 7 of 11 sectors closed green, with energy (+1.30%) leading and technology (-0.90%) lagging. The advance-to-declining stocks ratio was a healthy 2:1.

Dollar General, THE discount retailer in the US, saw its share price drop more than 30% after an earnings miss and forwards guidance slashing, citing that its lower-income customers are struggling significantly in this economy.

Yields at the long-end of the curve rose, though the short-end remained largely unchanged, pushing the yield curve inversion (now less than 4 bps) of over to years about to end (see COTD below).

Little to report back from the currency and commodity front, with the US Dollar trying to recover from recent losses and the price of oil being even more volatile than usual.

As we head into the last trading session of the month, Asian markets are sharply higher as are Western index futures, making a fourth consecutive month of equity gains very likely. Chinese and Hong Kong stocks get a special mention this morning, up over two percent as I hit the send button for the final QuiCQ of the week.

Enjoy your weekend all!

The US 10-year treasury yield is at 3.863%.

The US 2-year treasury yield is at 3.900%.

That makes bring the yield curve inversion to 0.037.

We are now about to be witness to the “uninversion” of the longest inversion of the yield curve on record.

Stay tuned …