"If only we could pull out our brain and use only our eyes."

— Pablo Picasso

After Sunday’s retaliation attacks by Israel on Iran and Monday’s LDP ‘defeat’ in Japan, yesterday was kind of a “breather” session in our 9½ days of maximum exhilaration scenario outlined yesterday.

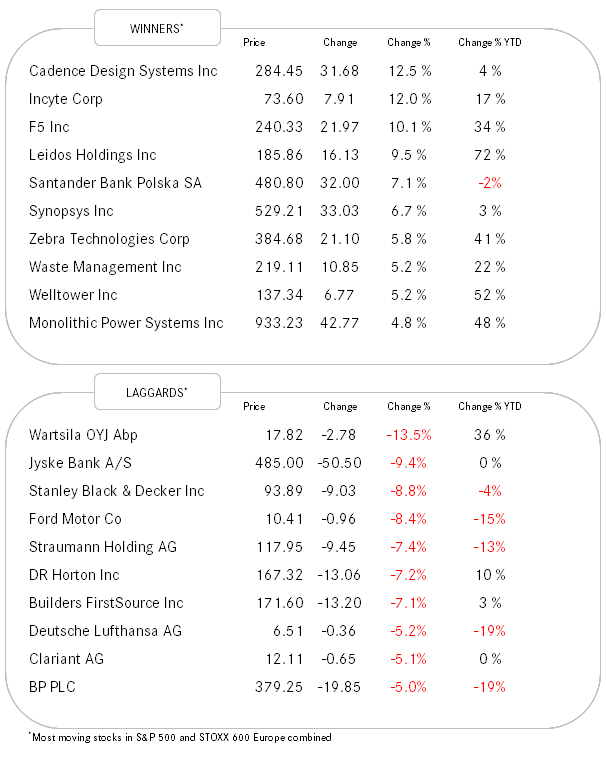

Hence, equity markets were pretty mixed, with Europe down, the S&P 50 and the Nasdaq up and only the Philadelphia Semiconductor index (SOX) smashing out the lights with a two percent plus run.

Despite the S&P’s small advance, there were actually twice as much stocks down on the day than up and only two (Communication & Tech) sectors out of eleven managed to print green. Utilities was the weakest sector, as the seventy basis point yield rise since the FOMC rate cut mid-September overshadowed any AI-related fantasy narrative.

Talking of yields, the Tens traded briefly above 4.30 in intraday yesterday, but since then have reversed quite strongly to 4.24% as I type. As mentioned in several QuiCQs last week, at least part of the recent bond sell-off (rise in yields) seems to be attributable to the Trump Trade (TT). Probably some profit taking on that part yesterday. I wonder if there’s more (yield) downside to come, as the TT-rally on Polymarket increasingly looks like on of those meme-stock momentum rallies …

In-line with the momentary reversal in yields has the US Dollar also started to soften a tad versus major currencies, ex the Japanese Yen which continues to trade weakish above 153.

Asian equity markets mostly lower this early Wednesday with the notable exception of Japanese stocks up about one percent (Nikkei). US index futures also trading higher, probably on the back of a positive earnings surprise by Google.

We normally speak about cryptocurrencies in general or Bitcoin in particular about every other month or so in this space, so writing about XBT for a second time already this week must surely be some kind of a contrarian sign :-)

Anyhows, in our weekly publication “The Quotedian” published last Monday under the name of “From Russia with Gas” and in yesterday’s QuiCQ we wrote about the seemingly imminent breakout of Bitcoin out of its 8-months long consolidation pattern and with a price at $72,300 as I write we have less than two percent to go to overcome the final hurdle.

Need a catalyst for that? What better catalyst than a US election, as today’s chart of the day tries to demonstrate: