QuiCQ 30/10/2025

“Don’t cling to a mistake just because you spent a lot of time making it.”

— Aubrey de Grey

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Fed cut rates 25 bp … ✅

Fed will end QT … ✅

Fed will cut another 25 bp in December … 🚮

Not so fast, said Fed Chair Powell last night during the post-policy announcement press conference. And given market reaction, investors had been positioned for one and two above, but did not see three coming.

As John Authers eloquently put it in his Bloomberg newsletter this morning:

“FOMC now stands for Furiously Opposed Monetary Commitments”

Anyways, stocks (S&P 500) took a ‘diver’:

(Editor’s note: any equity drop of more than 0.5% must be considered a ‘diver’ nowadays. Yes, being sarcastic).

The previously pretty complacent bond market got rattled awake, especially at the more interest policy sensitive short-end of the curve. Here’s the 2-year Treasury yield chart:

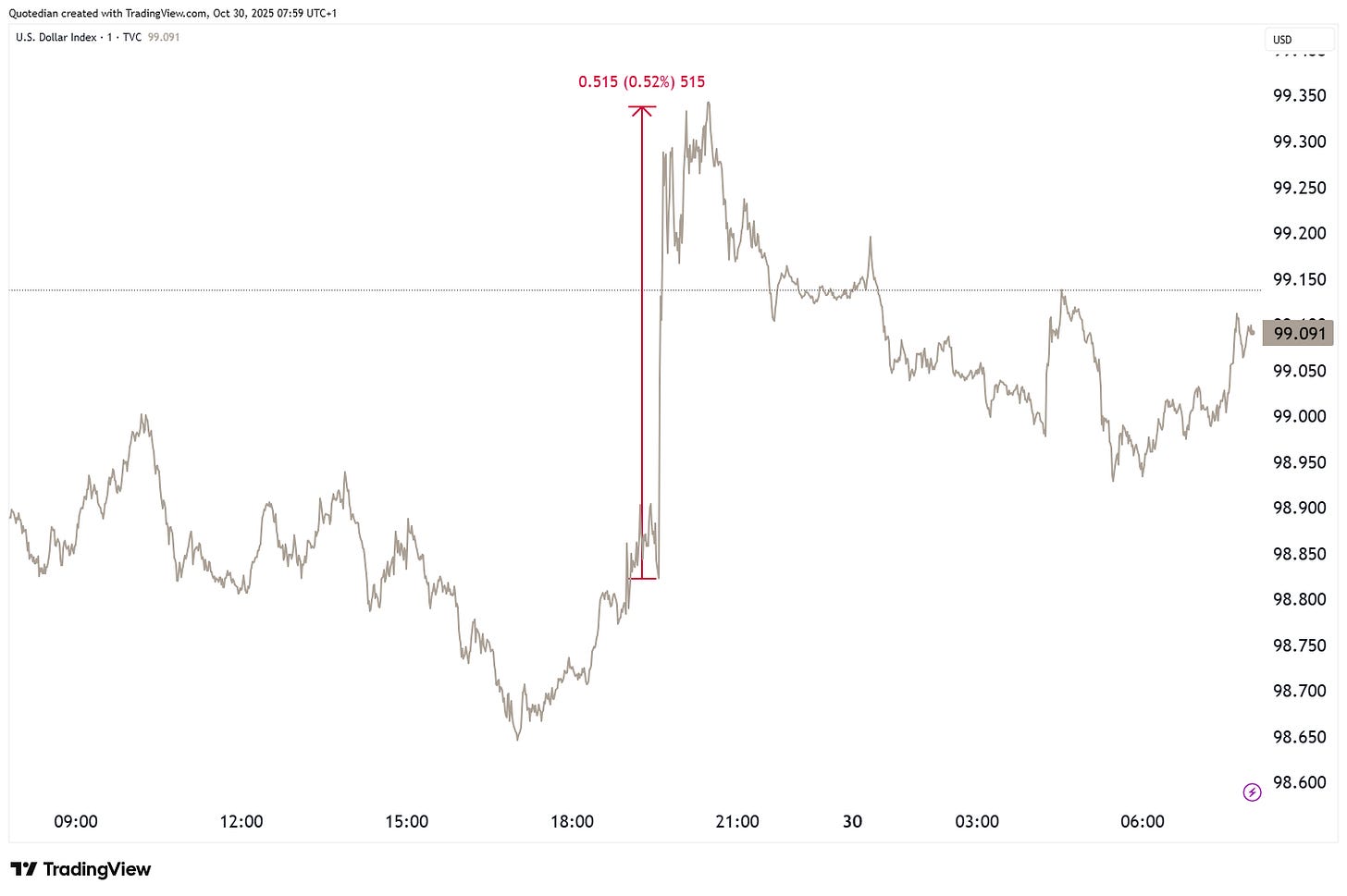

And finally, the Dollar (DXY) rallied,

on suddenly strongly reduced expectations of a rate cut given Powell’s hawkish comments:

But yesterday was not only about Fed monetary policy, but of course also about Mag 7 earnings. In short, MSFT (-4%) and META (-7%) disappointed, with investors increasingly joining our concerns about AI-spending and these hyperscalers de-hyperscaling themselves through a massive increase in fixed-costs …

GOOG (7%) results on the other hand delighted investors with a positive surprise earnings report.

NVDA did not report earnings numbers, but apparently it doesn’t have to in order to gain investors’ love, as the company’s market cap was pushed above $5 trillion after another three percent rally:

$6 trillion, that’s a lot of zeros: 6,000,000,000,000

The red arrow shows where NVDA exceed the $1 trillion market cap level, just slightly over two years ago. Crazy…

As I need to run into a meeting, let’s short-cut here. Back tomorrow hopefully with a slightly longer take.

For today, I leave you with this: Watch your bids!

André

The S&P 500 has spent 125 sessions above its 50-day moving average. That’s the longest stretch since 2011 and the third longest over the past thirty years or so:

Couple this with some excessively positive sentiment readings, and maybe we are in for a pause before the year-end rally continues. Stay tuned …