QuiCQ 31/01/2025

Tomorrow's Gold

“Friday is just the market’s way of confirming we survived another week of volatility.”

— The Quotedian

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Equity market on both sides of the Atlantic closed higher yesterday, partially still recovering from Monday’s slump, partially on the back of earnings results but definitely also on the back of central bank key policy interest rate cuts from the ECB (and the BoC and Riksbank) and a dovish pause by the US Federal Reserve Bank (aka Fed).

The S&P 500 closed up half a percentage point and is now less than a percentage point away from recording the second new all-time high of the year. But the real good news in yesterday’s session was breadth, with 413 stocks advancing!

No wonder yesterday’s heatmap is a sea of green:

The Russell 2000, a benchmark for small cap stocks, was up over a percent and also saw an advance-decline ratio in excess of two-to-one. The chart is starting to look constructive again as the index is swinging higher again at the lower end of its long-term uptrend channel:

In Europe, the uptrend has already resumed and Monday only seems a distant memory now (SXXP):

In the (interest) rates space, little movement on US rates, though the German 10-year bund yield dropped post the ECB’s 25 basis points rate cut announcement, kind of confirming the bond vigilantes agreement with the central bank’s move:

Hence the Fed’s staying put decision and the ECB’s cut has widenend the Eurozone-US interest rate spread (grey) again, which put immediate pressure on the EUR/USD cross (red):

Last but not least, we of course need to talk about Gold, which has closed above the November all-time highs:

We are currently neutral weighted in our tactical asset allocation in Gold, which in practice means a 5% exposure to this precious metal. Should we see the price of the yellow metal holding above 2,780 for the next few sessions we are likely to move to overweight.

Have a great weekend!

André

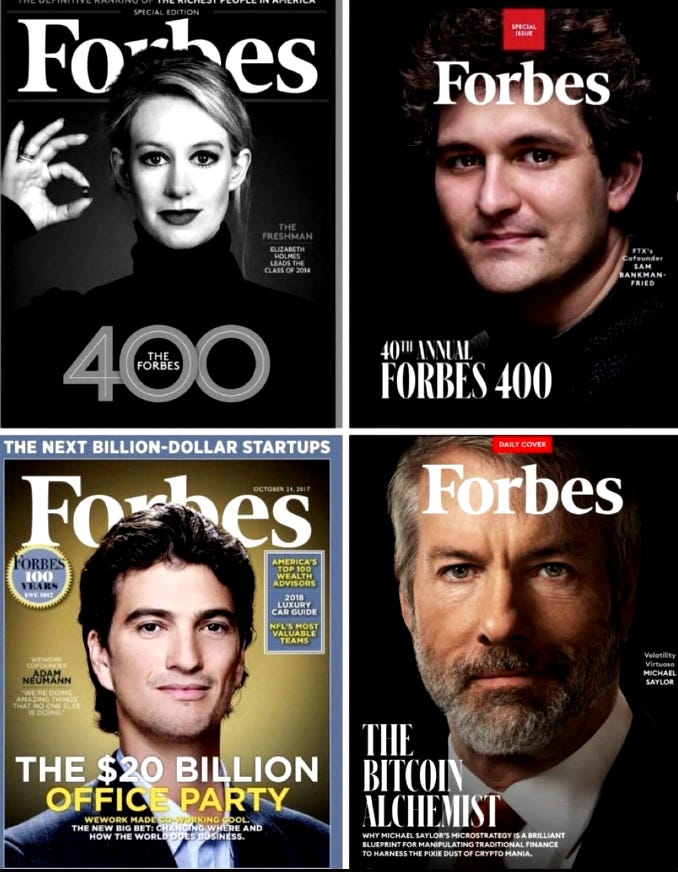

We have discussed the glossy-magazine-cover-contrarian indicator many time in this space and in the Quotedian.

Long-time and/or witty readers will immediately understand that it may be time to check the downside potential for MSTR! Everybody else sign up for The Quotedian (click here), to receive solution to the “riddle” coming Monday.