QuiCQ 12/07/2024

Rotation, Rotation, Rotation

Prefer to read today’s QuiCQ in PDF format? No prob, download it here!

"Rotation is the lifeblood of any bull market.”

-- Ralph Acampora

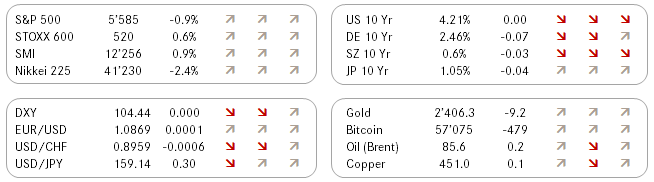

At the beginning of the week we published our Q3 investment outlook which you can find in summary here or in its 100-page+ ‘Full Monty’ version here. One of the major points was that we remain bullish on equities over the coming the months, expecting the participation in the rally to broaden from a chosen few to a wider range of sectors and companies. Well, we did not even have to wait a full week for that possible inflection point to occur. The US inflation (CPI) figure was reported a tad softer than expected and for some reason only obvious to the market gods, the collective investment public decided to sell the high performing stocks and rotate into the underperforming ones. E.g., the Nasdaq-100 closed down 2%, the Russell 2000 up 3.6%, or, as the today’s QuiCQ chart shows, the spread between the S&P 500 cap weight index (SPX) and its equal-weight version (SPW) was at its widest since Q3 2000. Is there more of this mean reversion to come? We think so!