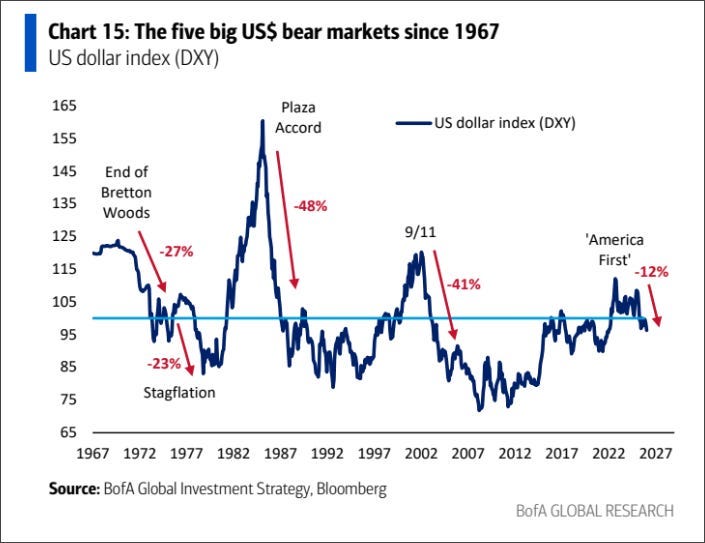

The QuiCQ 05/02/2026 - A NPB Original

Rotation, Rotation, Rotation

"Price is what you pay, value is what you get"

— Warren Buffett

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Maybe I should have started today’s QuiCQ rather with the opening line of Dickens’ ‘Tale of Two cities’:

"It was the best of times, it was the worst of times..."

However, the “worst of times” part is not bad enough to make that work - yet!

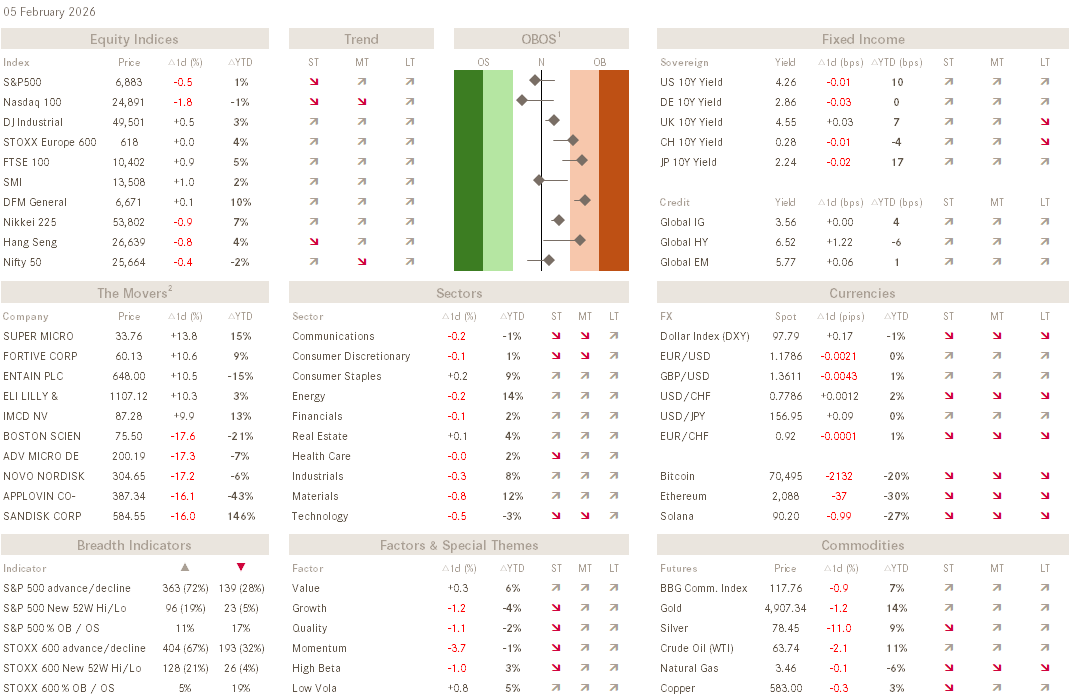

The Nasdaq-100 closed down two percent (-1.77%) yesterday, whilst the Dow Jones Industrial index closed up over half a percentage point, widening the YTD performance gap between the two further:

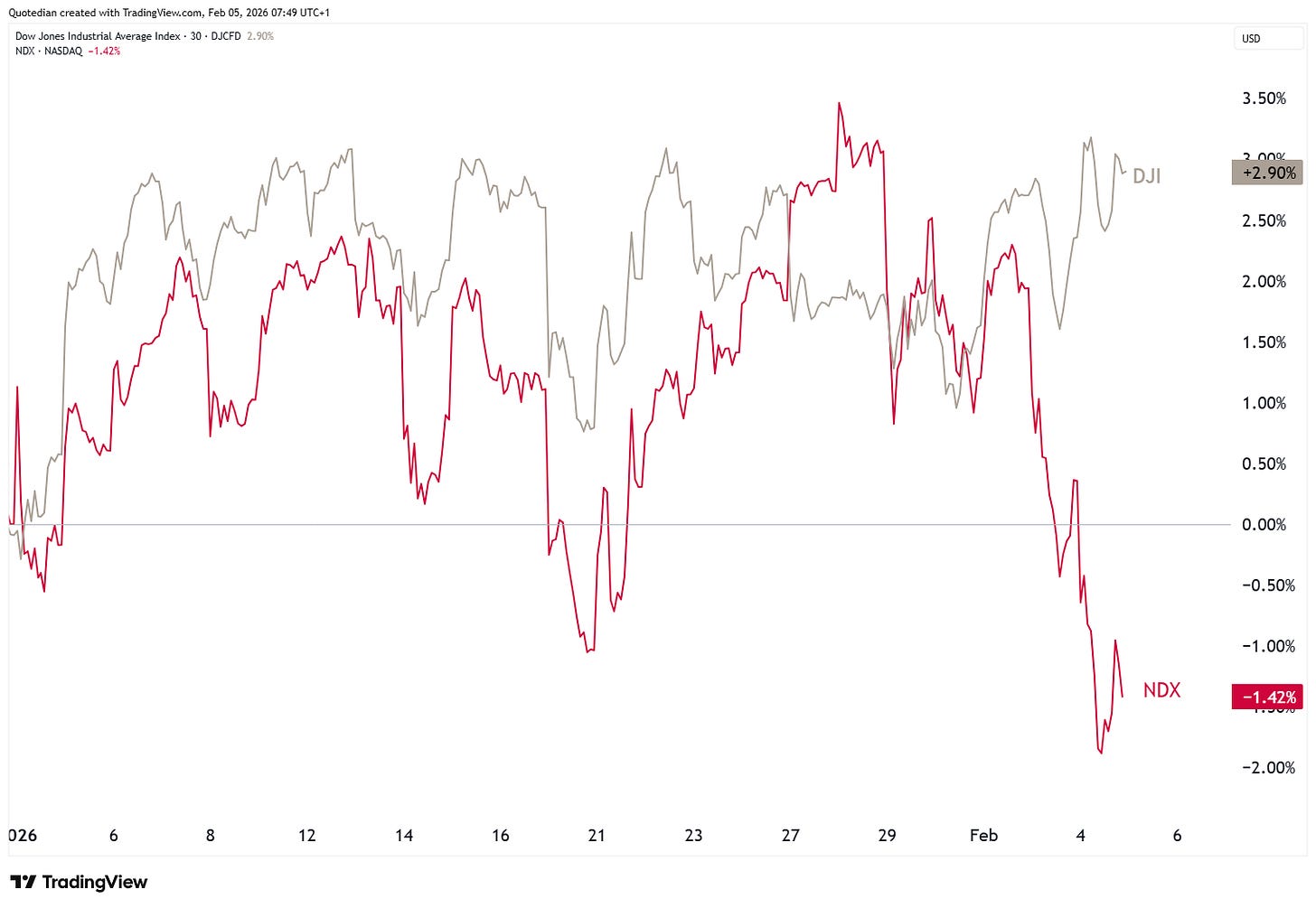

But the true story is here, when we overlap the following dark grey line:

So, what is that magical, dark-grey line then? The Russell 1000 VALUE stocks, i.e. large-cap value!

A clear rotation from growth into value seems to be taking place.

The most noteworthy part of yesterday’s session though seems to be that the unabated selling in Software stocks, aka SaaSpocalipse, could now be spreading to semiconductor stocks, which took a four percent plus hit on the day:

The rates complex (here the US 10-year Treasury) remains unequivocally boring,

and that’s a good thing! But, watch that 4.30% resistance …

In the currency realm, the USD (DXY) has been able to recover further after the initial slump of the year. The break below support at the end of January can now clearly be classified as a bear trap:

Nevertheless, given the sell-off in Gold and Silver, normally priced in USD, the greenback recovery remains mediocre in our view (see also: today’s COTD below).

Meanwhile, Bitcoin is continued to be getting hammered:

We now have broken way below our initial target zone, and the count has now changed to an inverse pole-and-flag pattern, with a new implied price target of somewhere between 60k and 50k:

Unfortunately I need to hit the send button to attend a first meeting, but we will discuss Gold and Silver, with the latter seemingly ready to full-fill our prediction from last weekend, either tomorrow or latest in the next edition of the weekly Quotedian (click here) due Sunday/Monday.

Have a great day,

André

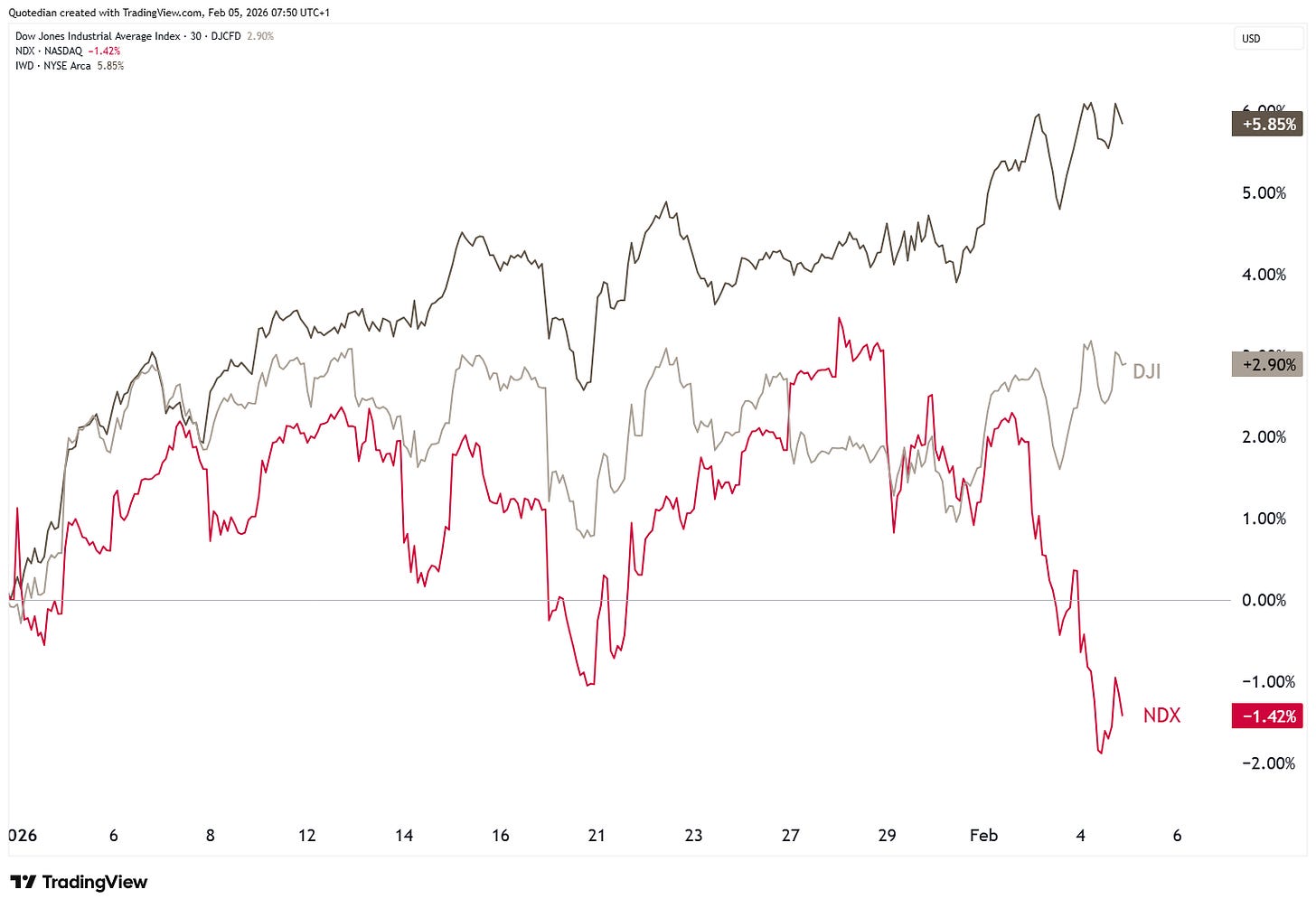

We showed a similar chart as the one below in Q2 of last year, arguing that USD bear markets usually are not only a few months and low double-digits. BofA seems to agree with us: