QuiCQ 13/09/2024

Stealth Rally

“When the oak is felled the whole forest echoes with it fall, but a hundred acorns are sown in silence by an unnoticed breeze.”

— Thomas Carlyle

Prefer to read today’s QuiCQ in PDF? No prob, download it here, but don’t you dare complain about the formatting!

Well, there we are. Gold is at a new all-time high and nobody hardly anyone is talking about it. This continues to be probably most unnoticed rally of a major asset class ever. As we have been writing in recent and not so recent past, there should be substantial more upside for the yellow metal and its precious companions (e.g. we wrote about palladium yesterday, up 5% since then). And not to mention the miners, just about to take off. Here’s the largest Gold miners ETF for example, but keep in mind we recommend an active manager we prefer over the ETF (contact us):

Over to the stock market, where Wall Street closed up for a fourth consecutive time on Thursday, leaving last week’s September swoon nothing but a distant memory. Whilst gains were not as extensive as during Wednesday’s session, participation (aka breadth) was much better. All eleven economic sector ended up higher, the stocks up versus stocks down ratio was a healthy 3-to-1 and forty-two stocks hit a new 52-week high, whilst just one closed at a 52-week low.

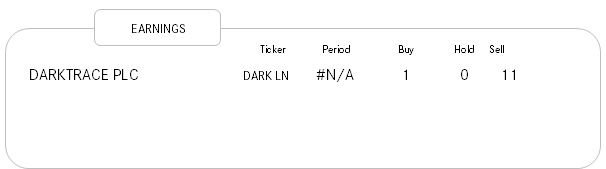

Earnings were dominated by Adobe (after hours -8%) and Moderna (-12%) both disappointed, whilst RH (after hours +18%) caught many by surprise with a earnings beat and a pick-up in revenue.

In the interest rate/fixed income complex we of course need to mention the ECB 25 basis points rate cut of their key policy rate, but given this was widely expected the immediate impact on asset classes including rates was … none.

Finally, in commodities not only precious metals had a good day yesterday, but also copper, oil, nat gas et al followed through with higher prices.

Friday Fun Fact (FFF) chart:

Yesterday was the 176th trading day of the year. The S&P 500 was up 17.6% year-to-date, while last year on the 176th trading day of the year, the index was up 17.7% year-to-date.

Fun, Fact and Friday.