QuiCQ 03/10/2025

Rocks over Stocks

“Mining is a search for the hidden wealth of the earth.”

— Sir Roderick Murchison

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

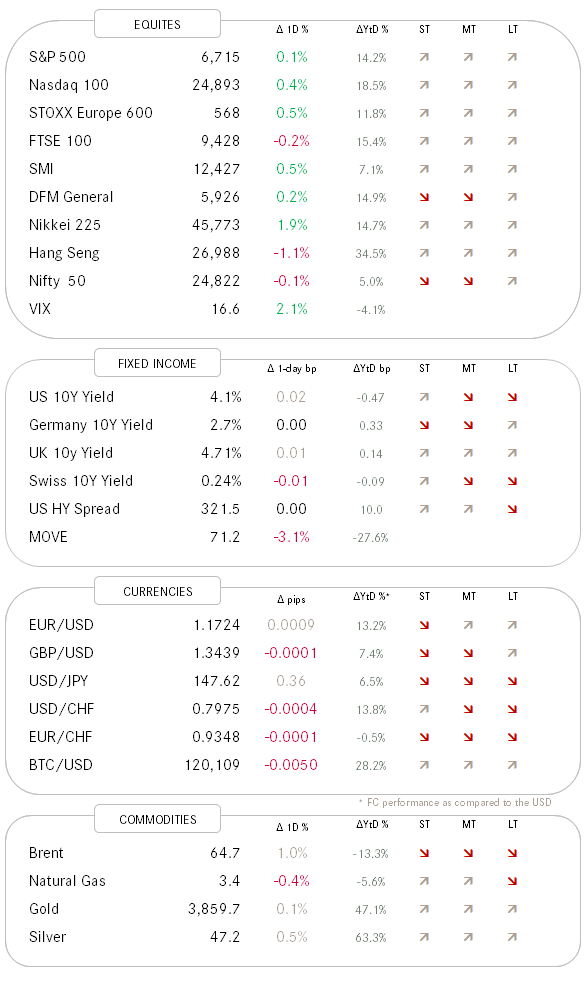

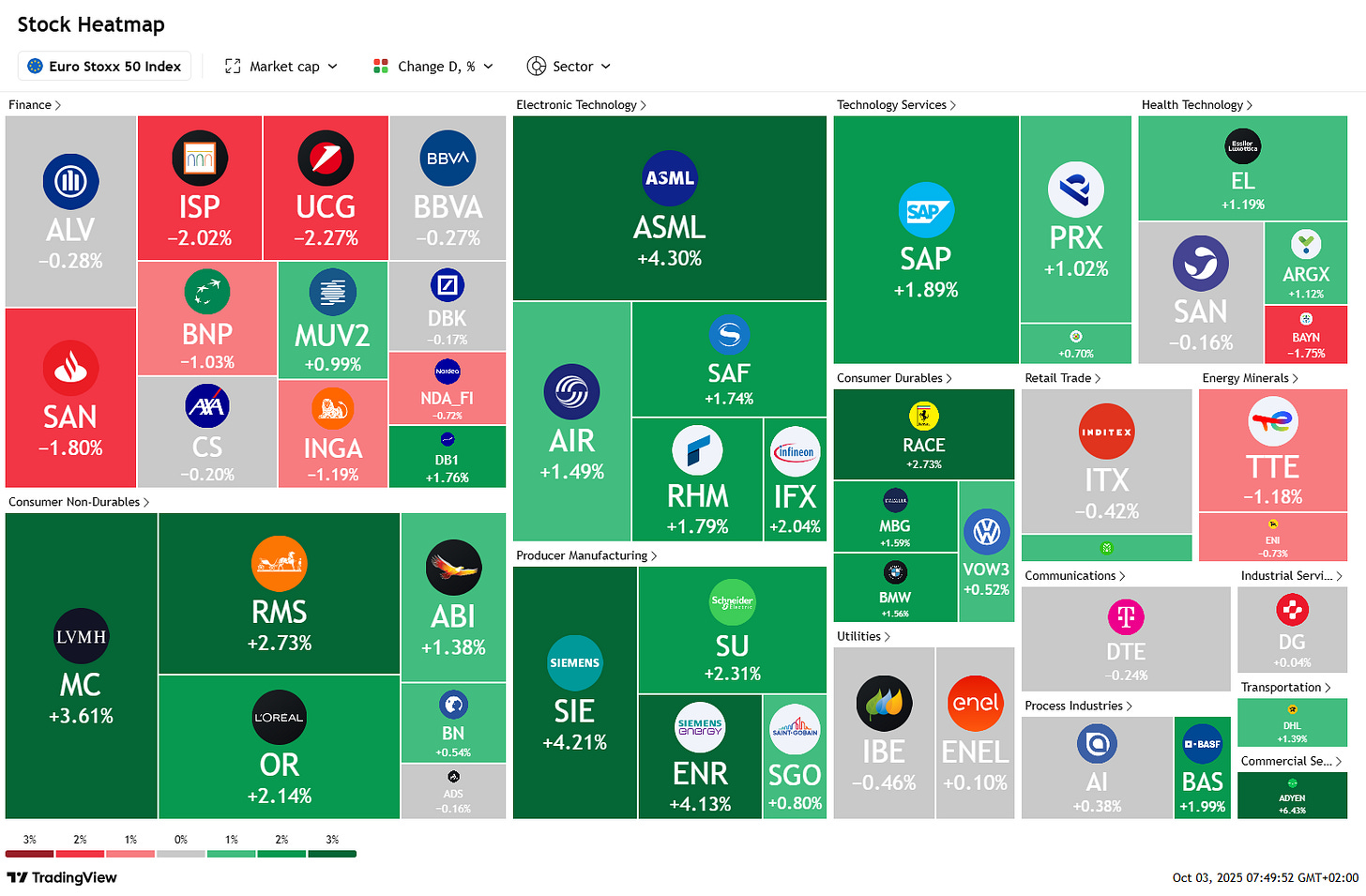

Yet another day, yet another new all-time high on all three major indices. BUT, not those three US indices no suddenly also got good company from the two most important European indices:

The narrow EuroSTOXX 50 index, which focus on the 50 largest Eurozone stocks,

and the broader pan-European STOXX 600:

With this, seven months of sideways agony seems to be over. Indeed, even though markets could correct this afternoon, next week, or whenever, such a broad, global breakout of stocks to new ATHs is NOT bearish.

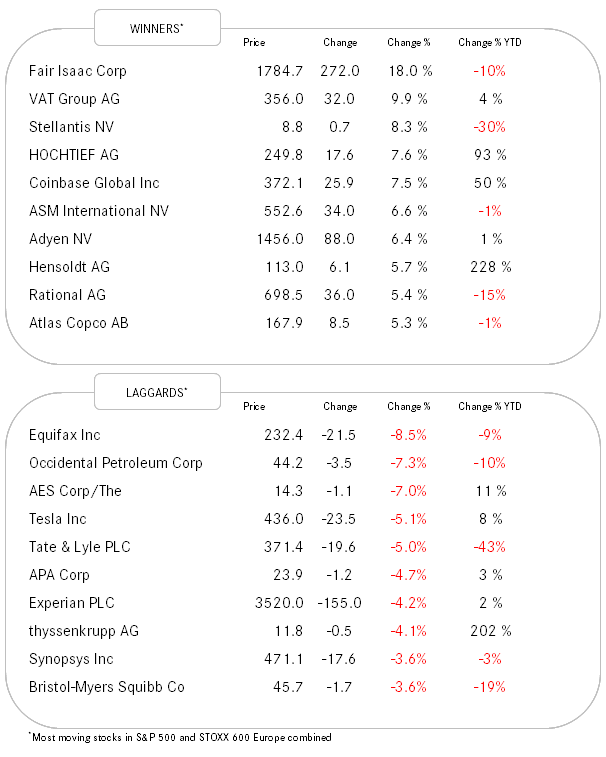

Here’s the heatmap of the EuroSTOXX 50 for a change (and we do not use the STOXX 600 as it gets a bit crowded):

We note that mainly the finance sector (top left) did not participate in yesterday’s rally, which fits a bit with the comments I made in yesterday’s note on US financials and which will be the main topic of Monday’s Quotedian, our long-from format newsletter.

I normally do not talk too much on individual stocks in either letter, but given some recent adaption to each letter, maybe I should. Here’s a simple example, a mention of Tesla’s sales number yesterday, which showed growth for a first time in quite a time and surprised estimates to the upside:

However, other automakers, including Ford Motor, General Motors and Hyundai, reported much sharper jumps in U.S. electric vehicle sales during the third quarter. Plus, a tax credit of $7,500 for purchasers of EVs also ended this week. Hence, a very nasty candle developed on the daily chart of TSLA, with the stock gapping up two percent at the open, then subsequently dropping seven percent to end the day down five percent:

The combination of this key reversal pattern and it happening close to the all-time highs, increase the odds that there’s more downside for the share price of TSLA…

Would these kind of comments on the QuiCQ be welcomed going forward?

Nothing specific to mention in rates or FX markets today, with maybe the exception of Bitcoin, which is humming in on its all-time highs again:

I have written on several occasions in the past few weeks about “Rocks over Stocks”, referring not only to the expected outperformance precious (and eventually industrial) metals of the broad stock market, but also the one of Rock-Stocks over non-Rock-Stocks (if you know what I mean). On our managed portfolios we implemented this with a specific active fund (become a client to find out which one 😉) , but the SPDR S&P Metals & Mining ETF (XME) is a good proxy:

That is one impressive run this year to have reached and exceeded the 2008 all-time highs!

Now, there’s two things left for you to do:

Check out the COTD below

Enjoy your weekend

André

Staying on the “Rocks over Stocks” theme the chart below shows that Gold miners (GDX - top chart) and Copper miners (COPX - bottom chart) have both topped out in 2011. Gold miners have taken out that previous top in September and adding to gains this month:

What do you think will copper mining stocks do?

I will play the catch-up, what will you do?

Stay tuned…

Your point about metals acting as an inflation hedge feels increasingly relevant - especially if rates stay elevated.