QuiCQ 05/06/2025

Early Summer Lull?

“Never short a dull market”

— Old Wall Street Adage

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Apologies for the recent irregularity on publishing the QuicQ, but due to

it was tricky to keep it up at the pace you have been spoilt with over the past years :-)

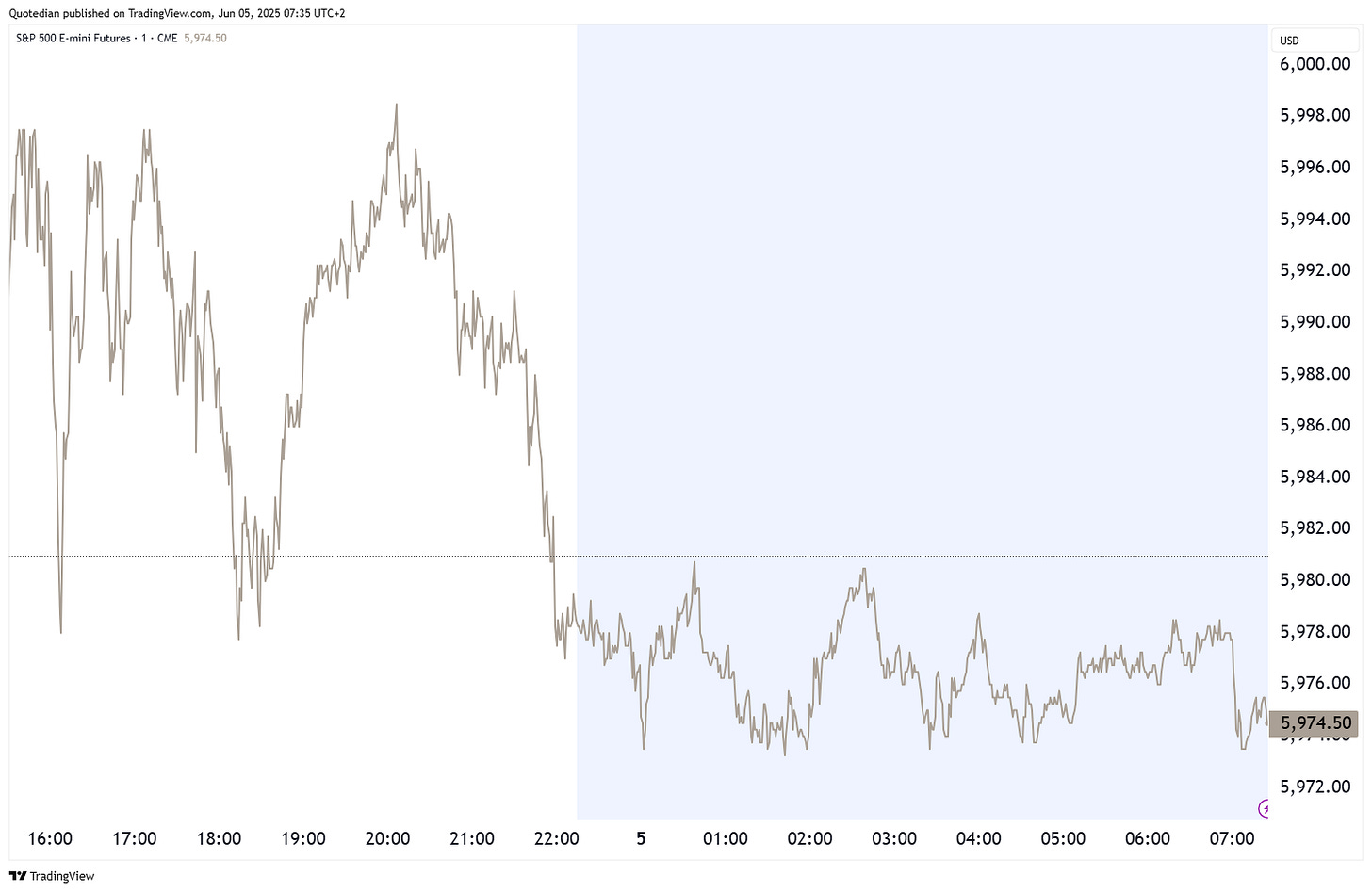

And then, on the first day we’re to publishing back in just about a week, we have to report about one of the probably most unexciting (equity) sessions so far this year. Here’s the intraday chart of the S&P 500 mini futures, including the overnight session (shaded area):

Despite or amid weak economic data releases in the US, which saw ADP Employment change and the ISM Services index numbers way below expectations,

the stock market help up until about the last hour of trading after which it dropped to close flat (+0.01%) on the day. The index continued to weaken after the closing bell, but mind you, that distance on the chart above from the very top to the very bottom is about 0.40% … YAAAWN.

The advancers/decliners ratio was 2:3, but most stocks moved so little, we cannot take about a sea of green or red on the heatmap, but rather a sea of grey on cloudy day (hey, that rhymes!):

As you probably have already extracted from the map above, communication services was the strongest sector whilst energy stocks made up the tail end.

Where there WAS some action was on the rates side of matters, where the yield on the 10-year US treasury bond plunged on a double-whammy of weak economic data. Here’s the intraday chart:

Falling yields is called in another financial jargon “duration rally” of course, and hence the long-duration TLT ETF saw one of its best days this year:

Not difficult to deduce from there then that the US Dollar did not have a great day:

The EUR/USD is closing in on key resistance and previous cycle high at 1.1520:

In commodity markets, Gold has been strong over the past week or so, but Silver has been even stronger. Time for silver to catch up to its more precious cousin?

This early Thursday, Asian markets are mixed with Japanese stocks down about to the same extent that Hong Kong stocks are up. Today’s focus on the ECB (surprise, surprise, they will cut), Mr. Merz’ visit to Mr. Trump in Washington and AVGO (a NPB focus list stock) after the closing-bell.

Time's up, more tomorrow - May the trend be with you!

Here’s a second quote of the day for you. As William Shakespeare wrote in Henry IV, Part:

“Uneasy lies the head that wears a crown.”

Prince Hermes’ market cap now exceeds that of King Louis …