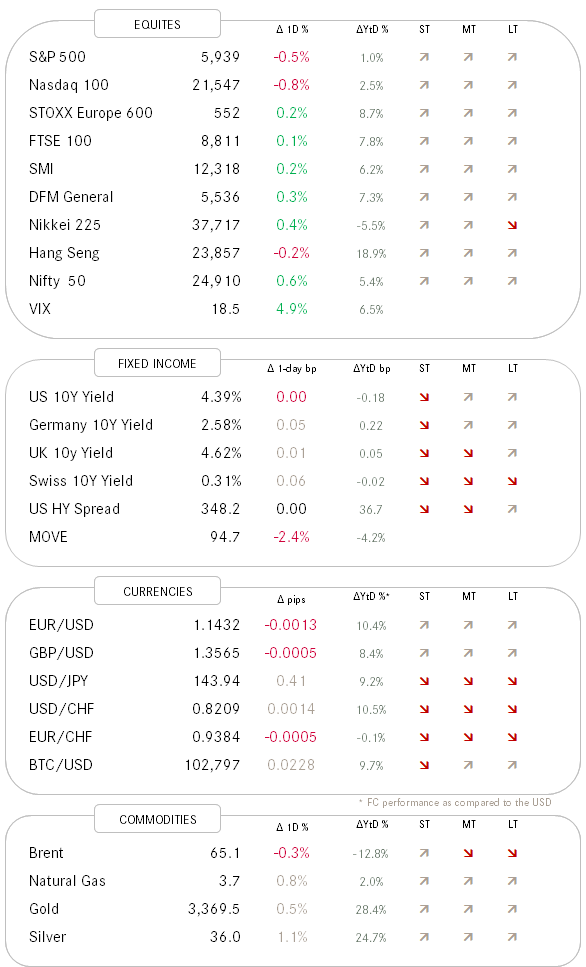

QuiCQ 06/06/2025

War of the Roses

"There is no winning! Only degrees of losing!"

— Gavin D’Amato (Danny DeVito) in “The War of Roses” (1989)

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Who cares about:

Trump not publicly ridiculing Merz yesterday

Xi and Trump actually speaking over the phone regarding trade

The ECB cutting rates

The RBI (Reserve Bank of India) delivering an outsized rate cut

The upcoming NFP number

when you can get the popcorn out

and see the new version of the 1989 blockbuster movie “War of the Roses” unfold in new, present-day adapted social media version?

Here are just two of the niceties exchanged in the “War of the Tweets” yesterday:

Trump vs. Musk:

Musk vs. Trump:

And hence, in reference to today’s Quote of the Day by Gavin D’Amato aka Danny De Vito, here’s yesterday’s intraday chart of Mr. Rose’s Tesla:

And here’s the intraday chart of the other Mr. Rose’s Trump Media & Technology:

To the above, you may add another 10% loss in the Trump Coin too….

Anyway, let’s leave this sandbox skirmish aside for now and concentrate on more serious matters …

The S&P 500 had another dull day yesterday (make reference to the COTD in yesterday’s QuiCQ what dull could mean), especially so if you would take out the price action on TSLA, which made up more than 20% of the overall volume and bunch of index points. As a matter of fact, studying the market heatmap we quickly note that a vast majority of stocks saw very small advances or declines on the day, with two reds (TSLA, TLSA) standing out:

In bond markets, European rates were in focus, as the ECB cut 25 basis points as expected, but unexpectedly quite strongly indicated that this may have been the last cut. President Christine Lagarde summarized it nicely yesterday saying that “probably we have almost finished the rate-reduction cycle this time around”.

Hence, the German 10-year Bund yield, as proxy for European rates, jumped over 10 basis points once the press conference got underway and the market had to start pricing in the possibility of no further rate cuts, versus previously two more expected:

As fore-mentioned, India’s RBI cut the their policy rate by 50 basis points which was double the expectation, sending the stock market higher,

and Indian 10-year Government bond yields nowhere (after some initial shock reactions):

Little to report from the currency front, but precious metals are on the move again, especially silver and platinum.

Regarding the poor man’s gold, resistance from this cycle high has been clearly taken out now:

And remember that catch-up chart between Gold and Silver from yesterday’s QuiCQ:

To be noted, that in the last inning of the rally, silver tends to grossly outperform gold …

And here’s Platinum, finally, finally waking up:

Today, all eyes on the US non-farm payroll number, with maybe an occasional glance at the Roses’ Twitter feed 🤣

That’s all for this week - we should be back next Tuesday, if time allows us to publish The Quotedian on Sunday/Monday.

For those who get a long weekend thanks to Pentecost, enjoy! For those who don’t, hold the fortress for us 🙏

Not a chart today, but a picture that now is worth a thousand words …