QuiCQ 07/03/2025

Flip Flop

“Expect the best, prepare for the worst, and capitalize on what comes.”

— Zig Ziglar

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

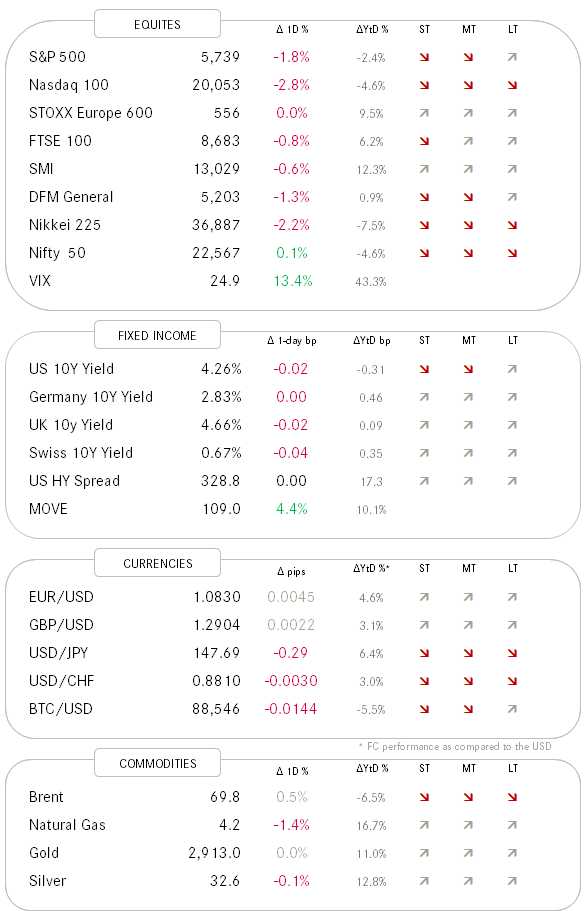

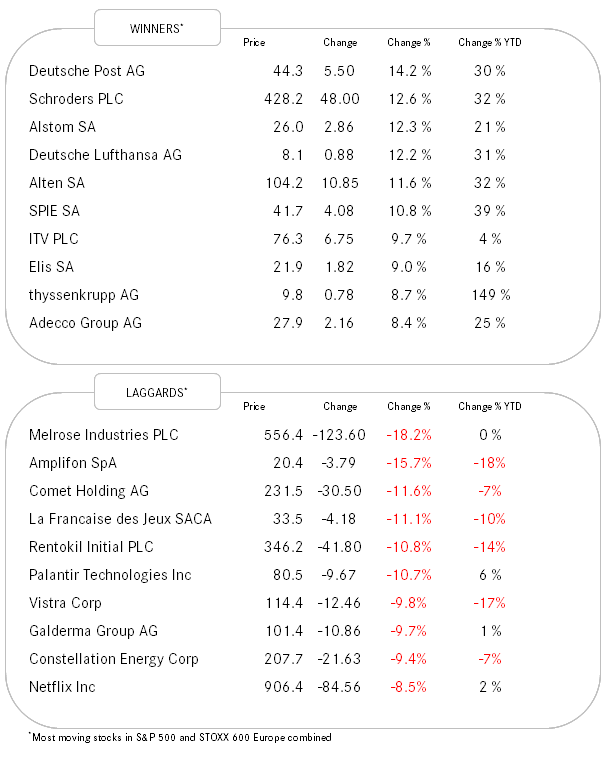

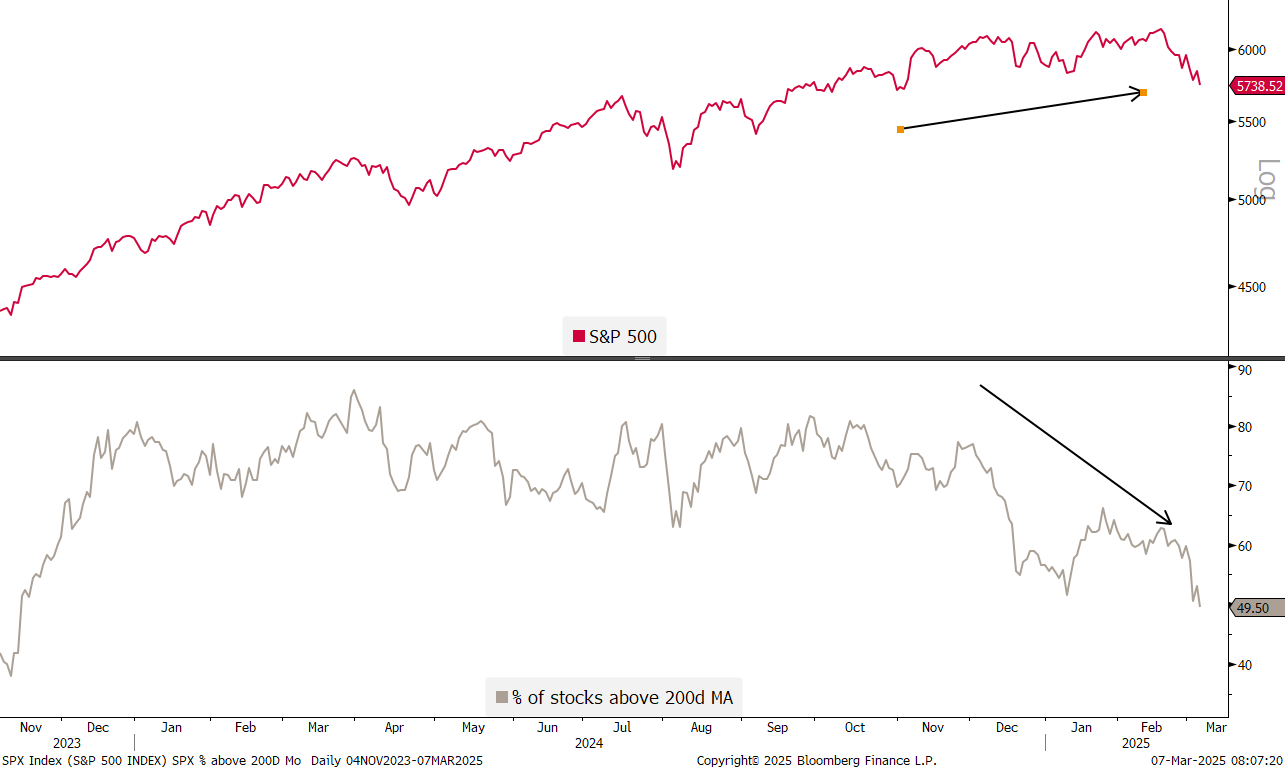

In yesterday’s QuiCQ in the ‘Chart of the Day’ section we highlighted how the Nasdaq 100 had its second longest streak of trading above its 200-day moving . Well, at 497 days, that streak ended yesterday:

What’s pushing stocks lower? We will have a closer look in this week's Quotedian out Sunday evening/Monday morning, but it is probably a mix between economic slowdown, increase in unemployment (see today’s NFP), market rotation (see more on this here) and above all, US trade policy uncertainty. Point in case, the Baker Bloom and Davis index of trade policy uncertainty, derived from analysis of media mentions, has just spiked to the highest in the 40 years since its inception:

Yesterday there was more flip-flopping on tariffs as US President Trump signed executive orders reversing executive orders he had signed two days ago … feeling confused and overwhelmed? You are not alone, believe me!

Hence, let’s do what the QuiCQ has been created for: Concentrate on the markets’ messages and filter out the qualitative noise. For more opined views, tune in on the Quotedian every weekend:

As forementioned, the NDX closed below its 200-day moving average first time in a long time and the S&P 50 avoided that feat fate only thanks to a small recovery rally from intraday session lows:

The next few sessions will be crucial for the immediate future for both indices, but the market breadth readings of the past few sessions have not been very encouraging. Yesterday, twice as many stocks fells as rose (S&P) and my favourite indicator, the number of hitting new 52-week highs versus those hitting new 52-week lows, has been thinning out dramatically on the ‘new highs’ side. Simultaneously, the number of new lows are on the rise.

This is also reflected in the % of stocks trading above their 200-day MA, which now has dropped below 50%:

Hence, all in all the US equity market stand on shaky feet - the best we can argue for an at leaset short-term relief rally is sentiment, which is starting to be rock bottom, as expressed via the week AAII Bull/Bear survey,

and the CNN Fear and Greed Indicator:

After an exciting few weeks, US Treasury yields have calmed down somewhat, trading slightly lower yesterday after the disappointing Challenger employment report.

German yields as proxy for Europe continue to stampede ahead:

A lot of credit has now been given to futures spending plans … if the US economy continues to slow down (let’s today’s NFP number) than gravity should start setting in two on their European counterparts.

For completeness purposes I will also mention that the ECB cut rates as excepted by 25 basis points yesterday, but simultaneously mentioned that they are probably done. A hawkish cut, so to say …

In currency markets, the Dollar continues to bleed versus other major currencies. Here’s the performance of G10 currencies versus the USD over the past five sessions:

Last but not least, we got the following headline sometime last night:

For sure, Bitcoin must have rallied like mad, right?

Wrong.

I really need to hit the send button, but make sure to tune in on The Quotedian for more detailed analysis.

Enjoy the weekend!

André

Some Friday wisdom for you: