QuiCQ 17/10/2025

Cockroaches

“There’s never just one cockroach in the kitchen”

— Warren Buffet

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Or as Jamie Dimon, legendary JPMorgan CEO just paraphrased earlier this week: “When you see one cockroach, there are probably more”.

Yesterday, more cracks in the ceiling or better said, more cockroaches in the kitchen appeared after the first two sightings (First Brands & Tricolor) a few weeks ago. Zions Bank said Wednesday evening that it faced a sizeable charge due to bad loans to a couple of borrowers and Western Alliance then alleged yesterday that a borrower had committed fraud. The KBW Regional Bank ETF (KRE - grey) took a six percent diver, pulling down the Russell 2000 ETF (IWM - red) two percent along the way:

Not that I would pride myself (I do) for having called for this debt malaise, but for now, our Quotedian published on October 5th titled “Pirate Credit” (click here) seems pretty timely.

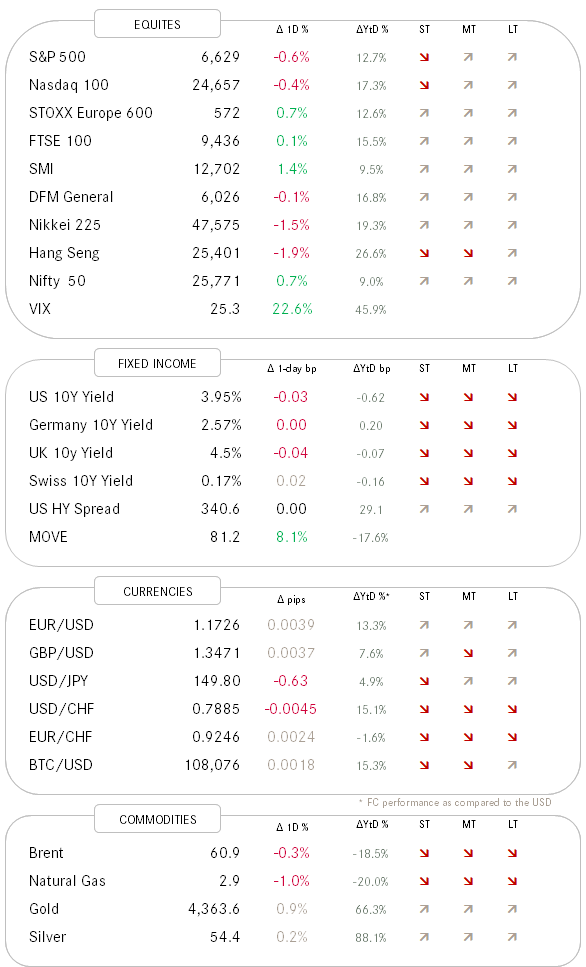

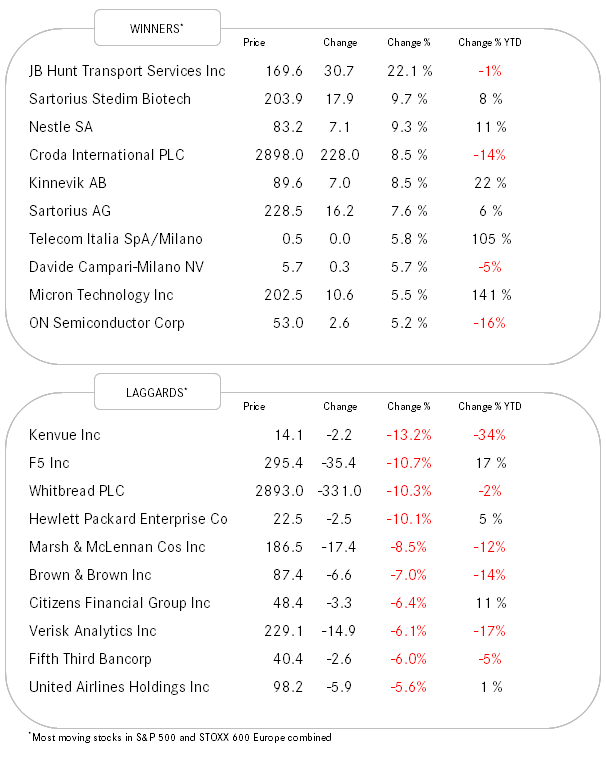

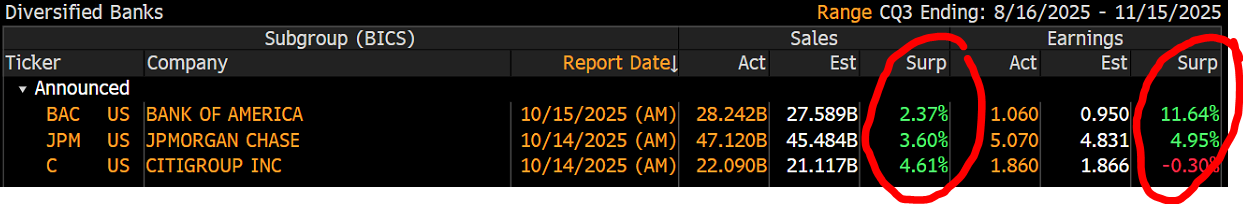

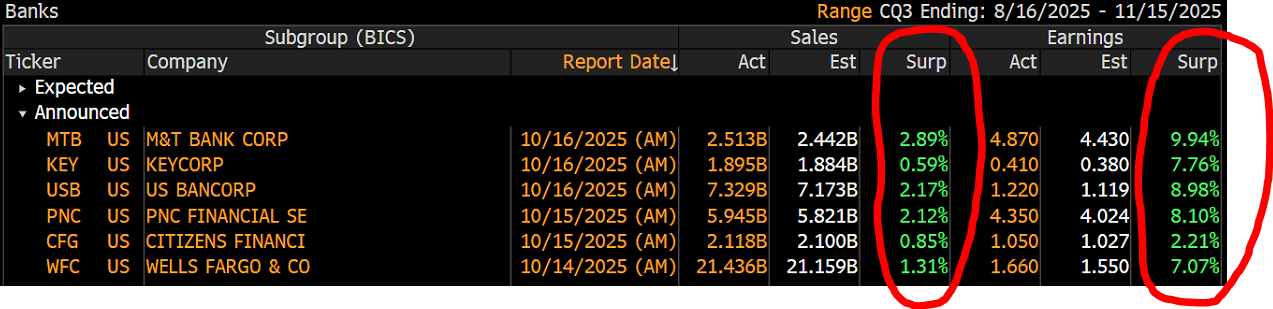

For now, contagion (or infestation in the case of cockroaches) seems contained, especially has the large financial institutions have been reporting brilliant earnings throughout the week:

The S&P 500 itself lost only 0.6% yesterday, but is given back another 0.7% this morning and has been pulled back to the 50-day moving average (ES1 mini futures):

Giving the benefit of the doubt, for now we think that 50-day MA will hold. However, should it not, the risks of a pullback to the 200-day MA (-7%) increase substantially. Yet, a welcome pullback to cull out the weak stocks and load up on the winners for a year-end rally.

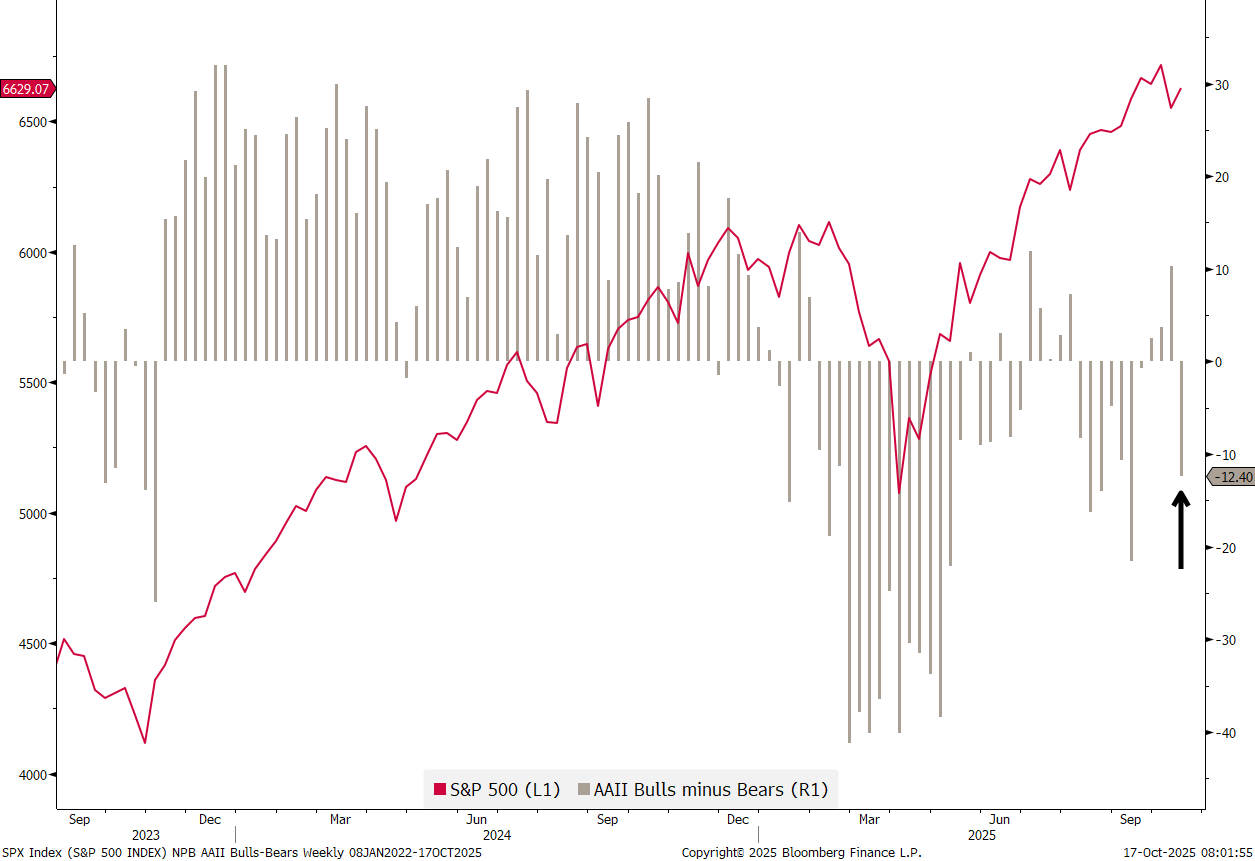

The AAII (retail investors) Sentiment Survey is always received on Thursday, and this week showed that the bears have already gained overhand again, increasing the odds that the current sell-off is indeed only a flash in the pan.

Bond yields have been selling off, pushing prices higher, as investors are seeking refugee in “safe assets”. Here’s the US 10-year Treasury yield:

Having broken the 4%-ish support line we are now on track for our 3.80-3.70 target zone.

But, of course, the favourite risk-off parking slot of the past year or two remains Gold (and other precious metals), which is heading for yet another new-all time high:

5,000 here we come?

Due to time constraints I will cut short here - but make sure not to miss the Chart-of-the-Day below.

And make double-sure to enjoy your weekend!

André

The COTD of the QuiCQ two days ago (click here), showed that the price of Silver had become very overbought (RSI) on a weekly chart and that this normally boded bad for future 12-months returns.

Let’s take another angle today …

The long-term silver chart below highlights the two previous occasions when this metal went into blow-off mode. It shows the percentage gains from roughly the preceding cycle through to the blow-off peak:

A similar move this time around would take Silver anywhere between $120/oz and $155/oz.

Stay tuned …