QuiCQ 19/03/2025

Buy the Rumour, Sell the Fact

“Everything we hear is an opinion, not a fact. Everything we see is a perspective, not the truth.”

— Marcus Aurelius

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

As today’s subtitle suggests, yesterday was a bit about “buying the rumour and selling the fact”, especially with regards to the confirmation of the lifting of the German “Schuldenbremse”.

The positive outcome of the parliamentary vote was well expected and hence largely priced in, with some notable exceptions which you will find above in the ‘Winners’ table (e.g. TKA, RHM, SSAB) of “The Movers” section.

The DAX (and MDAX) still closed up on the day, but gains had started fizzling away around the voting time:

How much a positive outcome was priced in was also visible in Bund yields, not only due to the duration (read: yield) sell-off post the spending plan acceptance but also the complete lack of reaction to a much better ZEW survey, beating even the wildest expectations:

But mind you, just to be sure on this, that German decision of yesterday is likely to go down in history books as a key moment for European fortunes and not only in financial market terms. Regarding this latter, of course it will take time for the money to hit earnings, given all bottlenecks and redtape, but psychologically, the old continent has a real watershed moment here, but we need to follow through.

Back to markets …

US markets went frosty again after two day of relief rally, with rotation out of growth continuing. A comparison of the S&P 500 Value ETF (grey) versus the S&P 500 Growth ETF (red) highlights this rotation:

Another clear evidence of rotation out of the “the future is technology” growth story is another 5% drop in Tesla, which we had already highlighted in yesterday’s Quick (click here) titled “The Tesla Chainsaw Massacre”.

For now, the S&P 500 has been quite precisely rejected in the zone we had highlighted in the last Quotedian (“Good buy or Goodbye” - click here):

US yields moved little in yesterday’s session, most likely in anticipation of today’s non-FOMC decision:

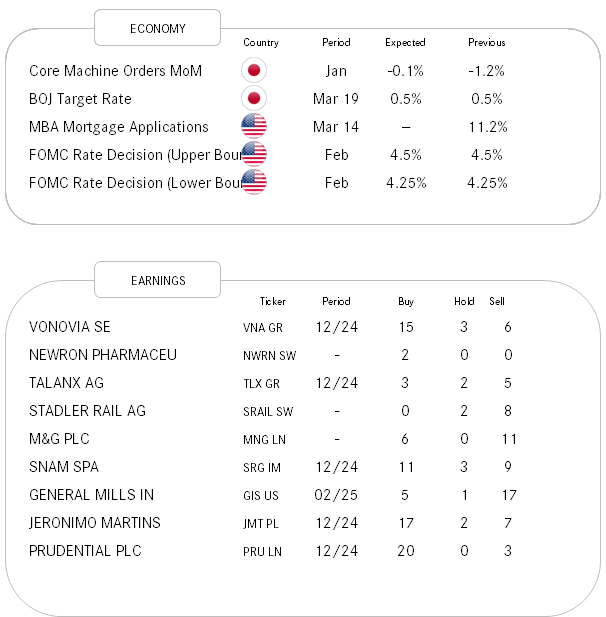

Whilst no cut (or hike) is expected,

a certain expectation has been building on how dovish Powell will sound during his ‘Presser’ given the recent bout of weaker economic data.

In currency markets, the US Dollar has strengthened a tad towards other major currencies over the past 24 hours,

though the USD chart (DXY below) continues to keep a more bearish tilt:

Definitely not bearish are neither Gold,

nor silver,

nor Copper!

Time's up, more tomorrow - May the trend be with you!

Not to beat a dead horse, but here’s the comparison chart of two EV-carmakers over the past three months: