QuiCQ 20/12/2024

Wound Licking

“I’m dreaming of a white Christmas. But if the white runs out, I’ll drink the red.”

— Anonymous

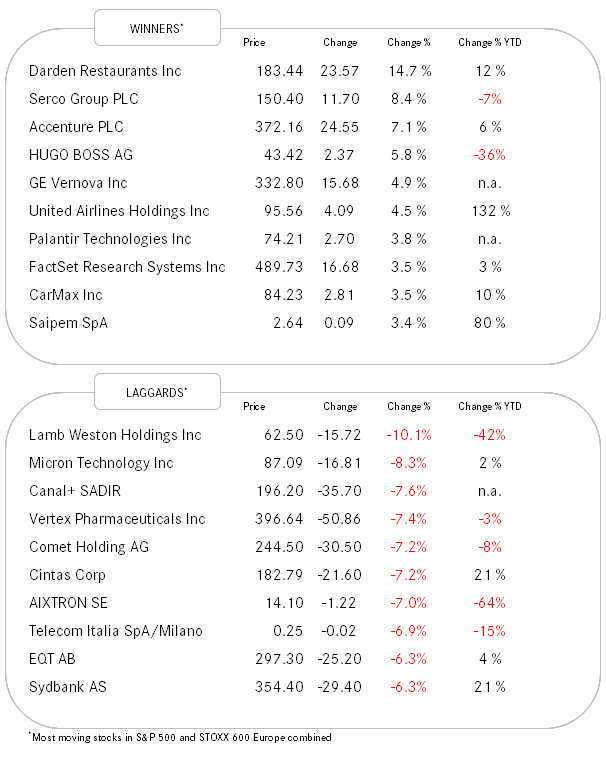

Yesterday was a wound healing session after Wednesday bloodbath, with stocks timidly trying to recover, but probably being held back by the (yet again) unfolding US debt ceiling drama.

This must definitely be the longest running soap opera sitcom in the US …

Major US headline indices (S&P, Nasdaq) closed a tad lower, pushed into negative territory in the final minutes of the session. Breadth on the S&P 500 was negative, with about three stocks falling for every two stocks rising, however, sector performance was not as defensive as one might expect:

Then again, there was quite the change in tone in our favourite daily statistic of new 52-week highs and lows, with only 2 reaching a new high but 46 hitting new lows.

Nevertheless, given the short-term seasonality, we could see some further advances over the coming few sessions and volatility should also relax further as today $5.8 trillion (!) of equity option notional will roll off.

Yields, real and nominal continued to push higher, probably also debt-ceiling-drama (DCD) induced. Do not ignore the 10-year US Treasury yield chart, even if you are an equity-only investor:

And another macro chart not to be ignored is the one of the EUR/USD:

Move above dashed = short-term pressure relieve

Move below dotted = buckle up

Gold has been under double pressure from a stronger greenback AND higher real rates:

Our call for “the top is in for the next few months” is suddenly looking timely again. :-)

Bitcoin in the meantime has fallen back below the 100k level, but the mania in altcoins seems to continue. Point in case, Fartcoin:

This was the last QuiCQ of the year. I hope you enjoy this new format we introduced a few months ago? What the heck, let’s do two QuiCQ polls, instead of the usual chart of the day:

1)

Those who opted for the third, bottom option, are of course obliged their suggest changes in the comment section:

2)

Merry x-mas and Happy New Year everyone!