QuiCQ 26/02/2025

One Earnings Report To Rule Them All

“I felt a great disturbance in the Force, as if millions of voices suddenly cried out in terror and were suddenly silenced.”

— Obi-Wan Kenobi

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

What’s been going the past 24 hours or so? Let’s check!

Wall Street (ex-Dow Jones) produced another day of losses, though it seemed very orderly in comparison to Friday’s mini-panic.

In that context, we need to put the four consecutive down sessions on the S&P into context (yes, AI software, I know I repeated context twice in the same sentence. Well, now three times actually…). The index is as a matter of fact only three percent from the most recent all-time high, leaving it clearly in the “green zone”, plus, prices rebounded quite precisely where they had to (circle):

Encouragingly enough, again more stocks were up (296) than down (206). Nevertheless, a tiny warning sign is coming from sector performance, where more defensive, less cyclical sectors led by consumer staples outperformed:

The Nasdaq is down five percent, which still leaves it only half-way from an ‘official’ correction (defined as a drop of 10% or more from recent highs).

European stocks were flattish, which of course means the relative outperformance to their US peers continues for now.

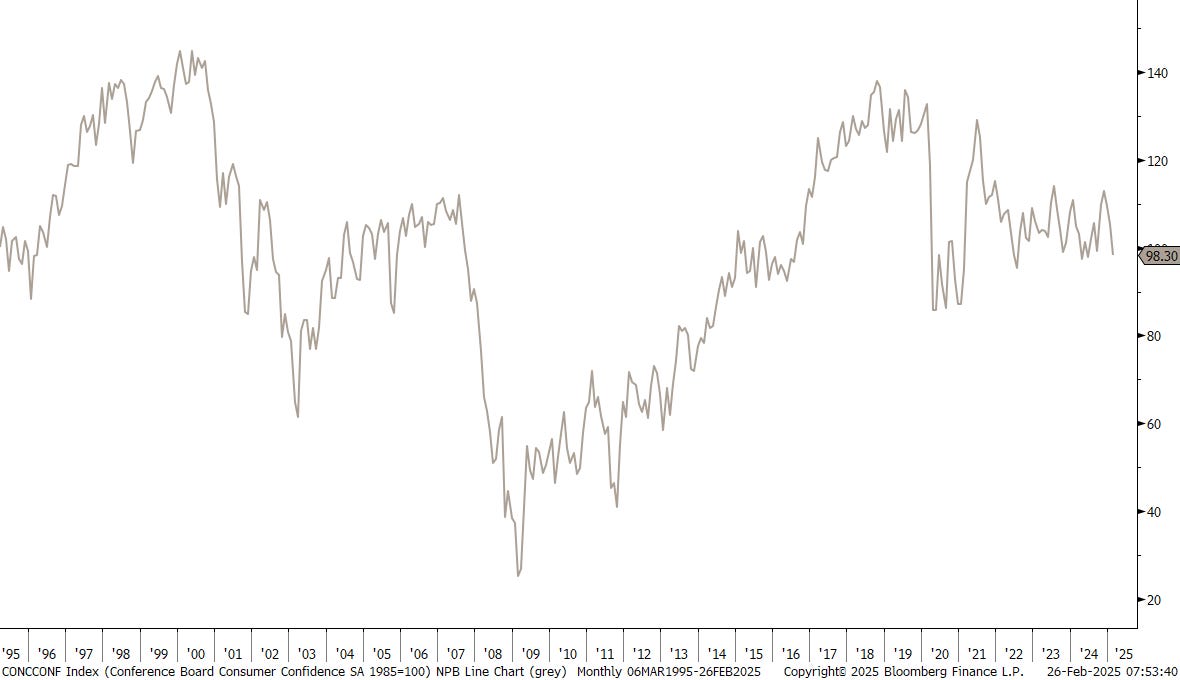

On the economic side, US Conference Board Consumer Confidence came in even weaker (98.3) than expected (102.5) and well below the previous reading (104.1):

Unsurprisingly yields dropped further on the above reading:

Nothing specific to mention from the fiat currency space, but in cryptocurrencies the weakness continues. As I foreshadowed in yesterday’s QuiCQ (click here), it was your last chance to buy Bitcoin above 90k, maybe for a while:

In the commodity space, Gold has given back some gains and trades just above 2,900.

Another commodity move raising our attention yesterday was a two and a half percent drop in crude oil. Related to OPEC+ (non) output cuts, economic weakness in the US or something else?

Second last, but not least, Asian stocks offer once again a mixed picture this early Wednesday, except for the Hang Seng index, which is a firm and undoubtful 3.5%, expanding further on already fantastic gains:

Are you participating?

European and US index futures point to a very friendly opening to the cash sessions on both sides of the Atlantic.

Finally, Nvidia will report its Q1 earnings today after market close. Let’s hope there is no need for Obi-Wan to repeat his words from today’s quote at the top of this letter …

May the alpha be with you.

We discussed in the past how consumer staple stocks (XLP) relative to the overall market (SPY), see lower clip, hit a new-all time low in December, taking out the late 1999 lows. Since then, the ratio has recovered, but maybe more importantly, on an absolute basis, see upper clip), the XLP hit a new all-time high yesterday:

Watch this space.