QuiCQ 26/06/2025

Full In On Semi

“He who has a why to live can bear almost any how.”

— Friedrich Nietzsche

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Your daily QuiCQ aims to strike the sweet spot: offering a nuanced take on recent macro developments in the investment world — more insightful than your run-of-the-mill market recap, but without descending into technical mumbo-jumbo or drowning in every last piece of corporate news. Are we achieving this? Cast your vote here,

and/or leave your comments in our suggestion box:

Onwards with market observations …

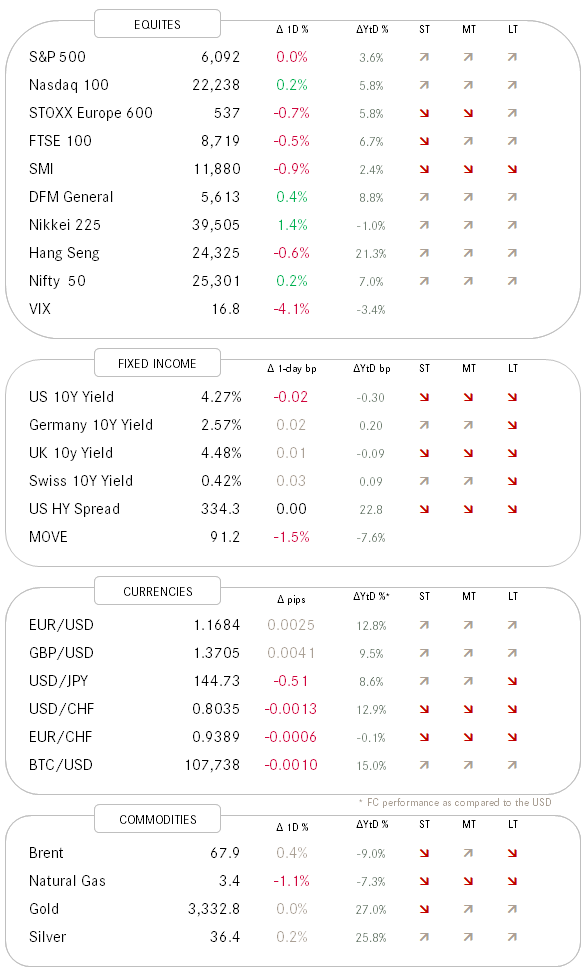

Yesterday the S&P 500 closed flat with the Nasdaq up about 0.2%. However, a quick dive under the surface reveals a much less constructive session, though one that probably can be shrugged off as some profit taking:

Yes, were it not for the good ol’ Mag 7 and some other megacaps, the outcome of the session would have been decisively more negative, as three stocks fell for every constituent advancing in the S&P 500.

Only three out of the eleven sectors closed higher:

And the more speculative corners of the equity market saw steeper losses:

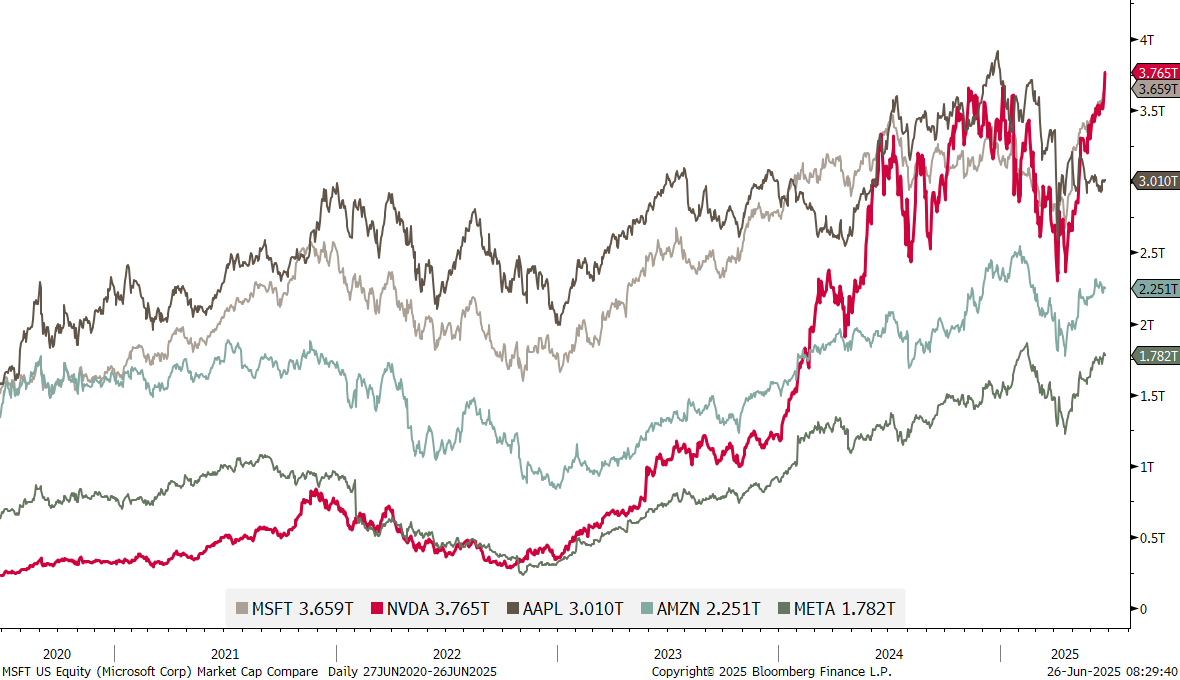

However, there were some important, positive developments yesterday. For example, the Philadelphia Semiconductor index, better known as the SOX, tempatively broke out to new cycle highs after a year of ‘sideways’:

This new high is important, as semiconductor companies are often considered to be a leading group of stocks due to their high cyclical nature.

The other point to highlight is that the Fed unveiled plans to roll back an important capital rule that big banks have complained limits their ability to hold more Treasuries and act as intermediaries in the $29 trillion market. This development seemed to have been well received by investors in the largest US bank. Despite the financial sector being down on the day yesterday (see above), large US banks actually showed decent gains:

Even more so, the one bank to rule them all, JPM, hit a new all-time high:

This latest development, also serves as a segue into the fixed income section, where this new possible treasury bond buying by US banks (up to $5.5 trillion of balance sheet space according to my all-time favourite NY hedge fund manager - Paul, you know who you are!), put downward pressure on yields. Here’s the 10-year treasury:

The US Dollar continues to show weakness, with the Dixy (US Dollar Index - DXY) now clearly having broken our defined support:

In the commodity space, Gold is stuck at just above 3,330, but anyway, that shiny metal is now sooo out of vogue. The new kid on the block is Platinum:

We’ll have a closer look at the relationship between Platinum, which actually is scarcer than Gold, in our next Quotedian, so make sure to sign up:

Sneak preview:

Ok, time to hit the send button, more tomorrow - May the trend be with you!

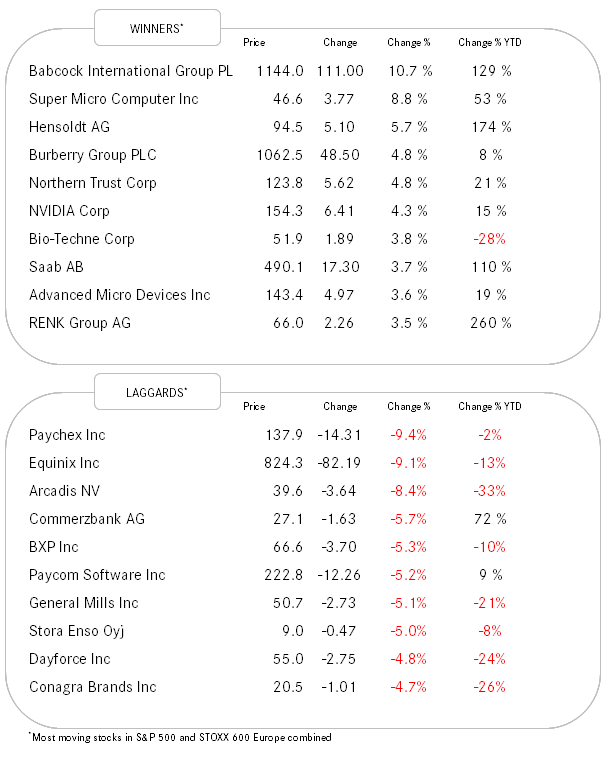

Semiconductors hit a new cycle high yesterday as discussed above. This move was led by NVIDIA, which hit a new all-time high and was single-handedly responsible for the Nasdaq 100 eking out a 0.2% gain yesterday:

But what is more, NVDA is now world’s largest company by market cap!