QuiCQ 26/09/2025

Too Much Good News

“No pleasure is bad in and of itself— only the possible consequences from overindulgence in those pleasures”

— Epicurus

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

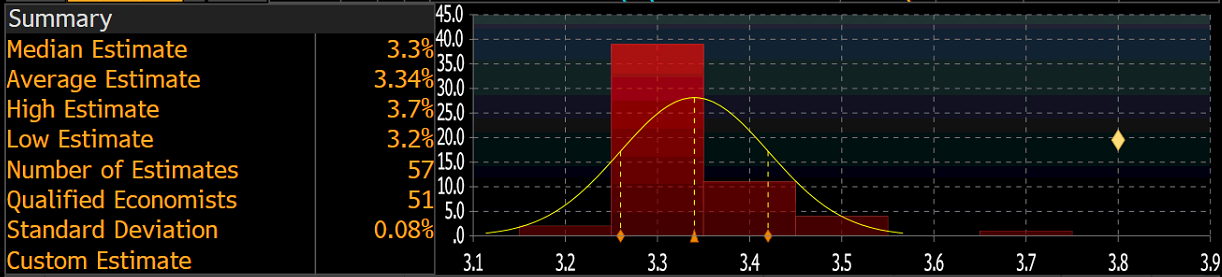

Too much good news? As markets dropped (very orderly, mind you) for a third consecutive day yesterday, we ask ourselves whether this weakness is baked on the good news of a strong upwards revision of US GDP (from 3.3% to 3.8%), beating even the most optimistic optimist,

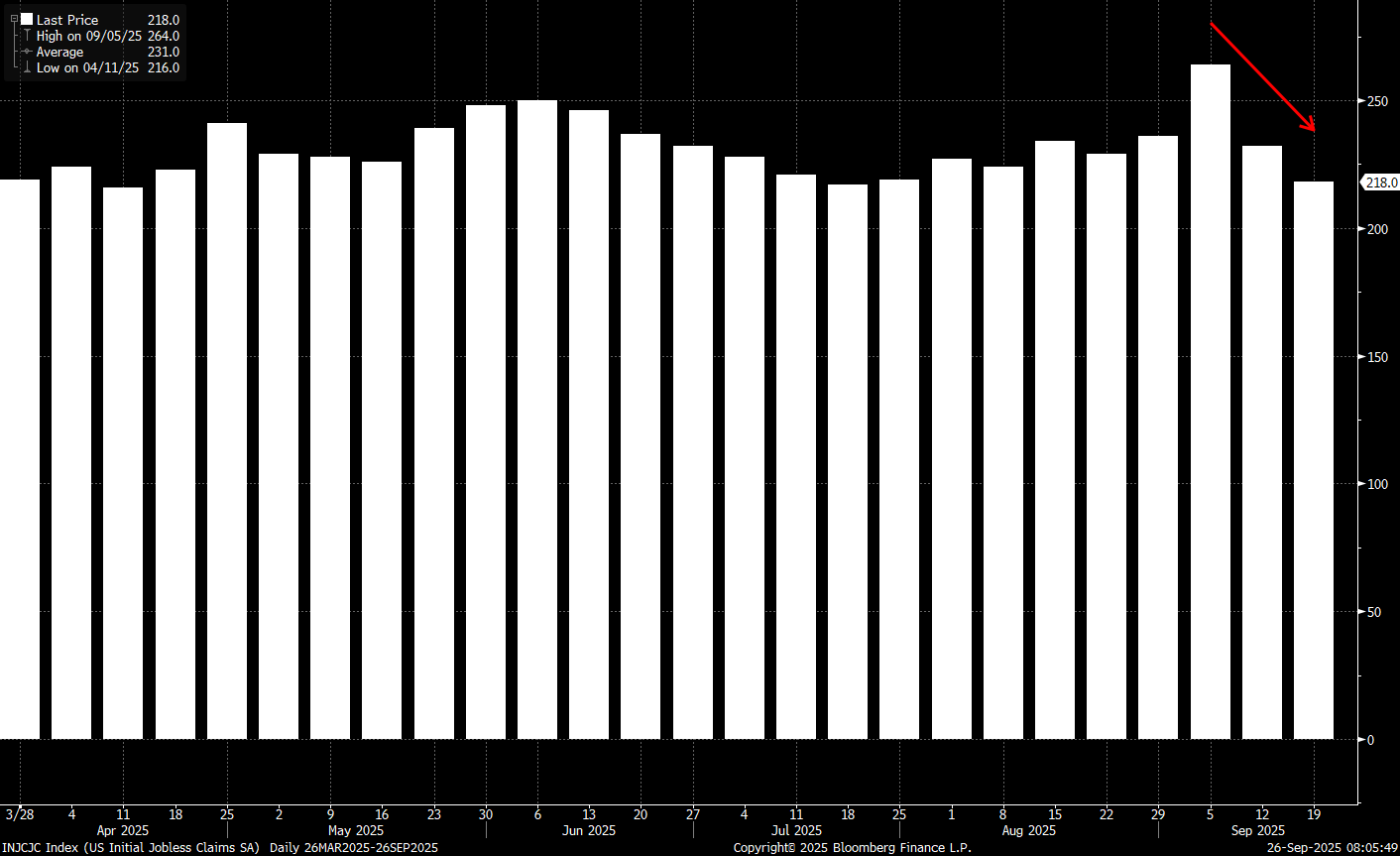

coupled with a third consecutive week of a drop in weekly jobless claims,

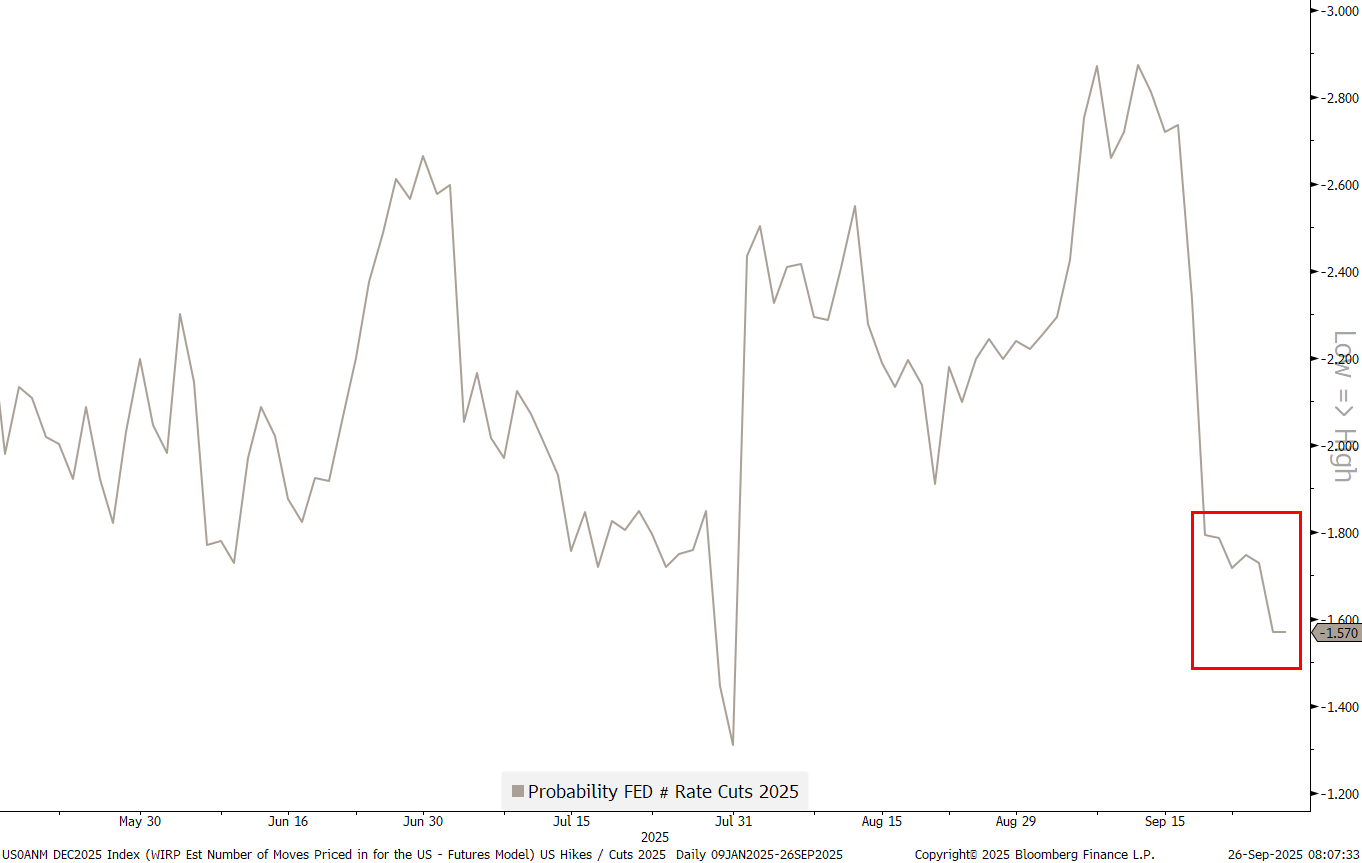

which in turn has led to a drop in the expectations for further FOMC rate cuts as derived from futures:

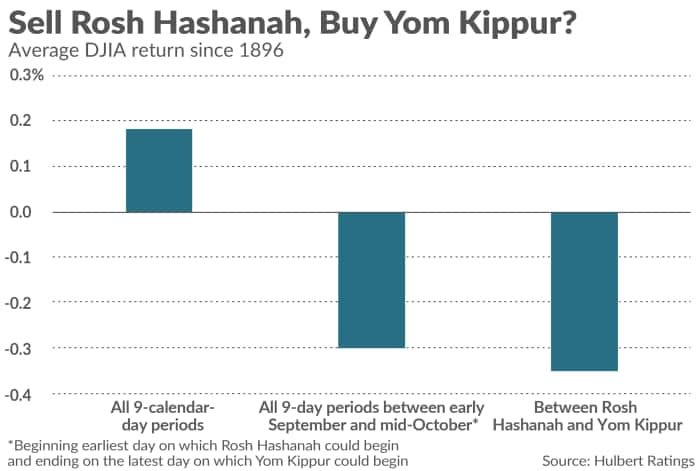

Or is it just the seasonal pattern, known as “Sell Rosh Hashanah and buy Yom Kippur”, which ‘dictates’ market weakness between these two important Jewish holidays:

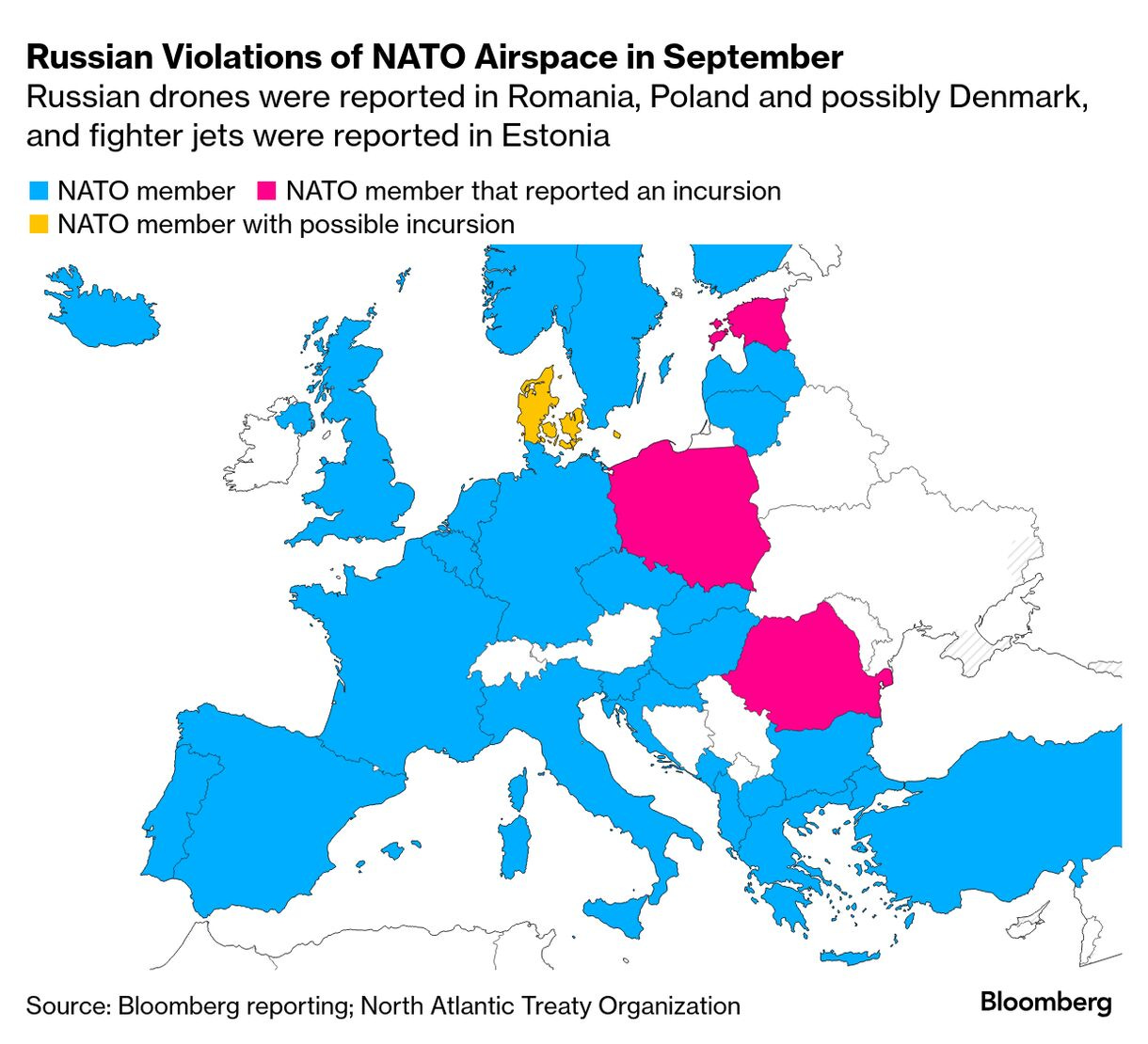

Or maybe the weakness is on the back of the geopolitical troubles drums which start beating louder and louder?

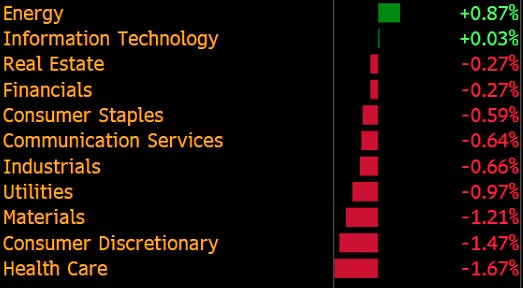

Hardly any sector escaped yesterday sell-off on Wall Street,

and breadth was dire with decliners outpacing advancers at a ratio of 3:1

I also note that my prop screen of new 52-week highs versus 52-week lows, the latter gained overhand the past two sessions for a first time in quite a long time.

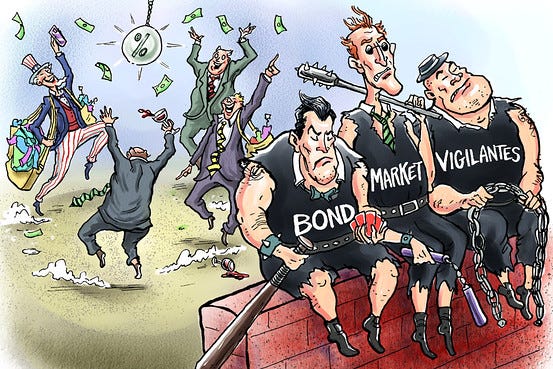

In fixed income markets, bond yields continue to rise. The pivot came rate post the FOMC rate cut and has accelerated further yesterday on the back of the fore-mentioned strong economic data:

The bond vigilantes are clearly getting nervous.

The Argentina bond market has found some relief, as Javier Milei is negotiating new pocket money in the form of a USD20 billion swap line with Uncle Scott. Here’s the price action on the current 10-year Argentina benchmark bond:

Likewise, the Argentina Peso (ARS) has rallied 10% on the back of those negotiations, recovering nearly all of its losses since those Buenos Aires elections a few weeks ago:

With that news that Germany’s Chancellor Merz is reportedly pushing to use €140bn frozen Russian FX reserves for Ukraine, I can only imagine that countries like China and India are closing watching and considering how much more of their reserves they will put into the Euro …

Completely unrelated 😉here’s the price of Gold, ready to break higher again:

That’s all for today - have a great weekend!

André

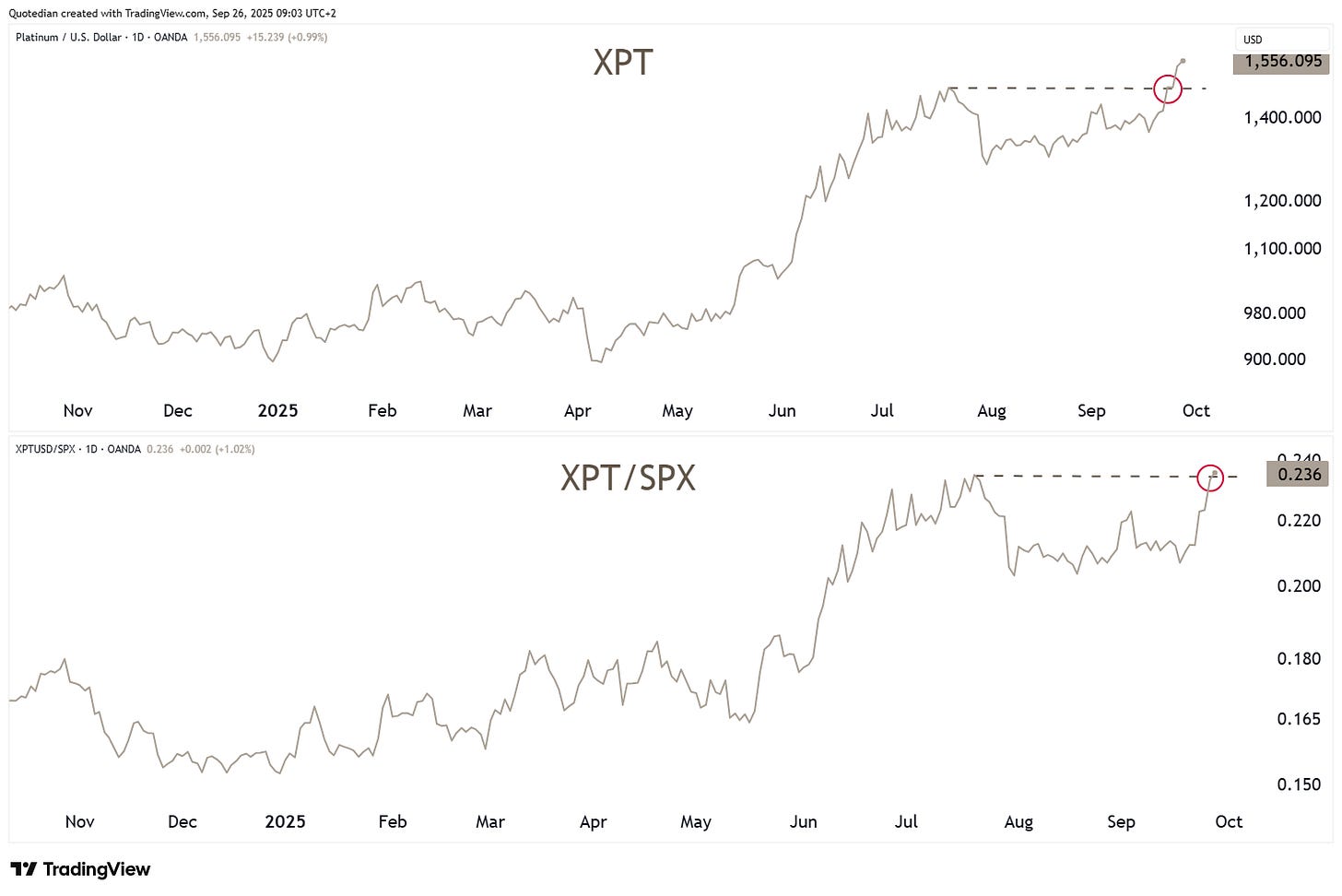

In Tuesday’s QuiCQ (click here) we wrote how Silver (SLV) was breaking out of a base pattern versus stocks (SPY) and indeed has that breakout been confirmed as Silver continues to rally and stocks put in a three-day streak of price declines.

But another, less observed precious metal, namely Platinum (XPT), as quietly the absolute star, up over 70% this year.

On an absolute basis (upper clip), XPT has already broken out above previous cycle highs, on a relative basis to stocks (lower clip) it is about to do so, which would be a strong trend confirmation signal:

So, even more Rocks over Stocks? Stay tuned …

Intriguing take — I hadn’t considered that the market softness might actually stem from ‘too much good news’ rather than weakness.