QuiCQ 31/10/2025

Trick or Treat?

“On a scale from zero to 10, with 10 being the best, I would say the meeting was a 12.”

— Trump on Air Force One after meeting with Xi on Thursday

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

I ended yesterday’s QuiCQ (click here), with the ominous expression:

“Watch your bid!”

With this I was of course referring to a possible impending correction on equity markets, as ‘things’ seemed to be getting a bit stretched. Not least, as the S&P 500 has been above its 50-day moving average for the third longest streak over the past thirty years as also shown in yesterday’s chart-of-the-day:

Well, turns out that was an excellent call as the S&P dropped one percent …

… for about half a couple of hours, as the market quickly recovered in after-hours futures trading:

“Culprit” for the rebound are mostly likely the earnings reports from the two last out of the five Mag 7 reporting this week. Apple is up 3% in after-hours trading on the back of solid earnings, but AMZN, up 13% after-market, completely shot out the lights, mostly thanks to increasing AI demand embedded in der AWS business unit.

So, what will it be for equity markets? TRICK or TREAT?

For now, the S&P 500 continues to trade some 3%-ish above its 50-day MA (smooth grey line) and it looks like a TREAT for the bulls who were able to load up on some more exposure during yesterday's sell-off:

I am still slightly more cautious that this could turn into a TRICK and a authentic Halloween scare.

So, continue to “Watch your bid!”, unless the S&P ekes out a new ATH today, which is only slightly more than a percent away.

Asian (equity) markets are not so much buying into the Wall Street overnight rally for now, with the exception of Japanese stocks.

First though, China mainland and HK stocks are down about a percentage point, as the Trump-Xi meeting has come and gone and somehow feels a bit like a non-event, or at least that seems to be the market’s verdict.

Japanese stocks are rallying another two percent (Nikkei225) this morning, probably on the back of the Japanese Yen having broken key support of the past few hours. Here’s the Nikkei chart first:

Bullish as hell, but probably also short-term somewhat overextended …

And here’s the chart of the USD/JPY, showing the Yen breaking down, i.e. the USD/JPY cross shooting above key resistance I had highlighted in the Quotedian (click here) earlier this week:

I could argue that my call for a lower USD/JPY put some egg on my face,

but I wont’t. Rather I would highlight a disciplined process, with a high reward/low risk trade gone bad. It is now back to the drawing board…

The JPY has not been the only currency weakening versus the US Dollar over the past few hours, but rather all G-10 (ex-$) softened:

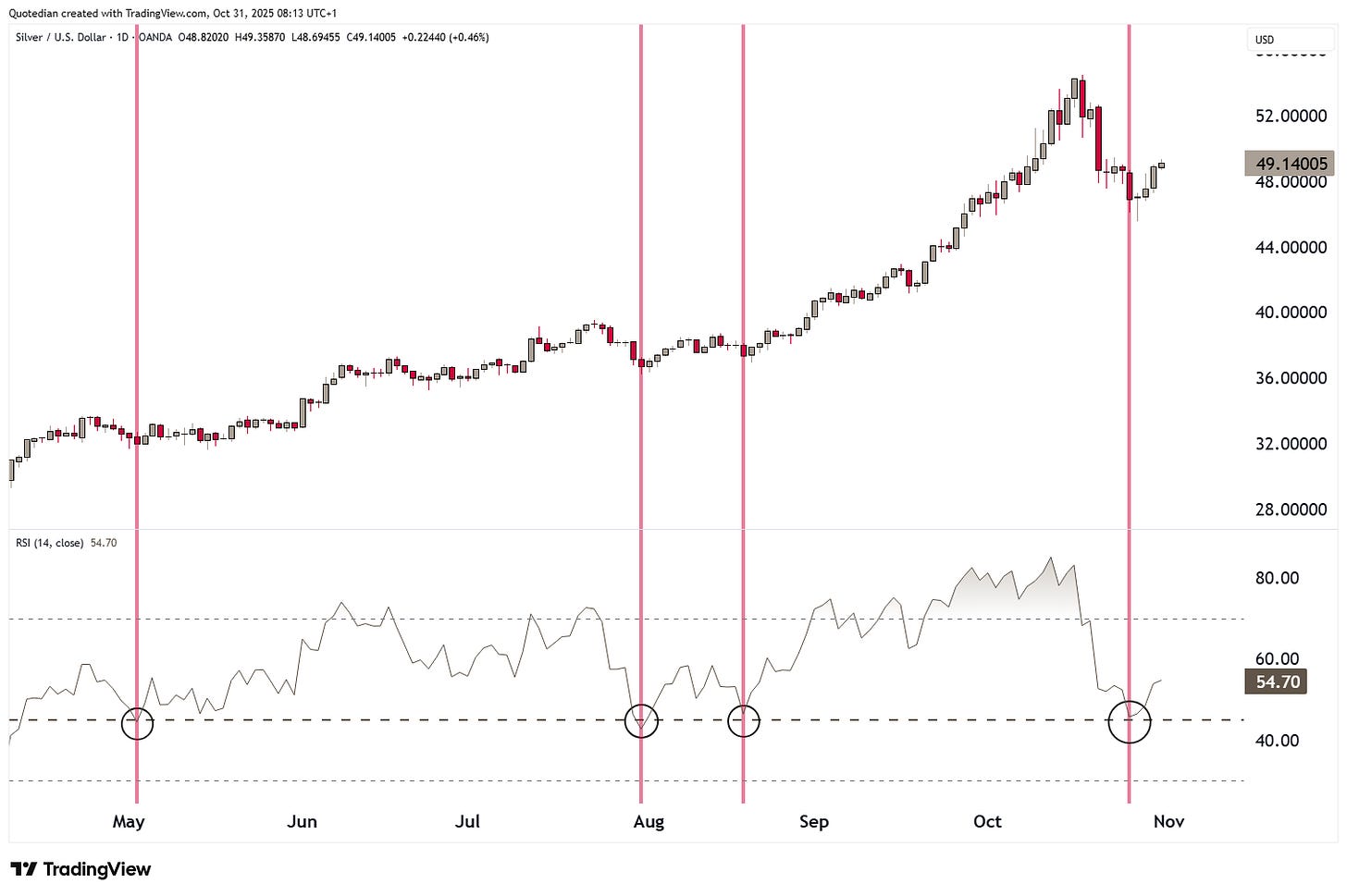

In commodity markets, Gold is trading above $4,000 again and Silver reclaimed the $49 level. The latter has seen its RSI turning higher again from a level which re-initiated short-term rallies in the past:

That’s all for today and this week.

Make sure to go and enjoy your weekend and, of course, pay attention to your inbox, as the month-end Quotedian will be released Sunday/Monday.

André